Before I would transition to what the Philipines does, I would fix the tax code. Originally Posted by adav8s28Before? We're already there. The difference is that bureaucrats working for the tax authorities in the Philippines can unfairly bankrupt businesses all by themselves. In the USA, it's more often done by lawyers. That's my very limited experience anyway.

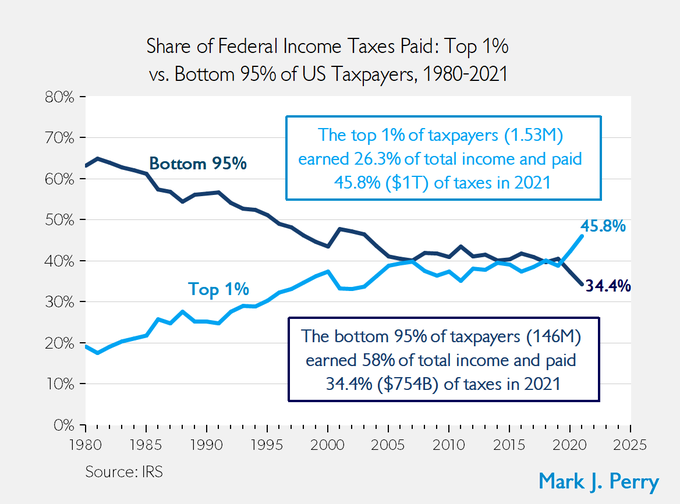

The one percent simply do NOT pay enough in Tax. In the tax tables their tax rate percentage is between 35 - 39%. What they are actually paying (Effective tax rate is no where near this), due to loopholes. Originally Posted by adav8s28See LustyLad's post. IRS statistics show the top 1% paying at a weighted effective average rate of 27%, while the bottom 99% pay at an average 15%. That of course doesn't include property taxes, sales taxes, death taxes, payroll contributions and state income taxes levied on both the top 1% and the bottom 99%.

https://www.irs.gov/statistics/soi-t...d-gross-income

The USA has the most progressive tax system in the developed world. "The rich don't pay their fair share" is an untrue political talking point.

For example the effective tax rate for Mitt Romney is 15% in any given year( he said this in public). I would lower to the tax rate percentage to between 30 - 34% and eliminate all or most loopholes. Originally Posted by adav8s28The 15% is now 23.8% as a result of tax increases under Obama. And why have fund managers historically been able to get away with paying 23.8% (formerly 15%) on their performance fees? Because of Chuck Schumer, that's why. Schumer's a crafty devil. He's done this while blaming other people, most recently Kyrsten Sinema, for Congress' failure to end this loophole. Texas Contrarian has written about his here.

I would change the Corporate tax rate to go back to 25%. It was too high before the Trump tax cuts. However, it's too low now. Originally Posted by adav8s28When you add in state income taxes, the current 21% federal rate puts us pretty close to the middle of the pack in the developed world. We're competitive. We're only quibbling about 4% though. We're definitely a lot better off than when the average federal + state rate was around 40%, the highest in the world.

Most of the money saved went to stock buybacks instead of investment expand the business. Originally Posted by adav8s28Another untrue political talking point. (Adav8s28, I'm not accusing you of spreading political talking points. Rather, I'm accusing you of watching too much MSNBC.)

The money went to increase investment, increase jobs, and pay higher dividends to shareholders who often reinvest said dividends (as well as funds received through buybacks) in ways that contribute more to economic growth than leaving the money in the companies.

This NBER paper may be instructive,https://conference.nber.org/conf_papers/f191672.pdf

From the paper, in the long run, going out past 4 years, even the United States Treasury benefits from the corporate tax cut, by collecting more revenues than it would otherwise.

You knock social security and Obamacare. Social security would pay for itself if they would change the formula. You don't have as many people in the working now a days ( birth rate has decreased). People are still having sex, they just aren't having as many kids. The formulas for Social Security has not changed since the program was implemented.Social Security is a Ponzi Scheme. It would be so much better for people to have their own investment/savings accounts.

As for Obamacare only 10 million people are on it. Over 285 million people get group health insurance thru their employer. BTW( A group health insurance policy from the employer is the cheapest health insurance one can get). Originally Posted by adav8s28

As to Obamacare, what I'm proposing, universal healthcare, is way more radical than what anyone except Bernie Sanders Progressives have proposed. The difference is that under the Tiny Healthcare Plan, physicians and hospitals and clinics would have to compete for health care dollars from the public, something they mostly don't do now. Obamacare is part of an outrageously expensive system. We spend something like 17% of GDP on healthcare, far more than the rest of the developed world. Singapore, whose system we'd copy, spends around 5% and has better outcomes. People live longer and they're healthier.

We spend way to much on Military Spending. There is just no need to have troops stationed all over the world any more. Originally Posted by adav8s28It's interesting that we both dislike Trump but agree with him on that.

I say look at these things before adopting that what they do in the Philipines. Originally Posted by adav8s28Like I said, I just really don't understand the analogy. Please explain.

Originally Posted by lustylad

Originally Posted by lustylad