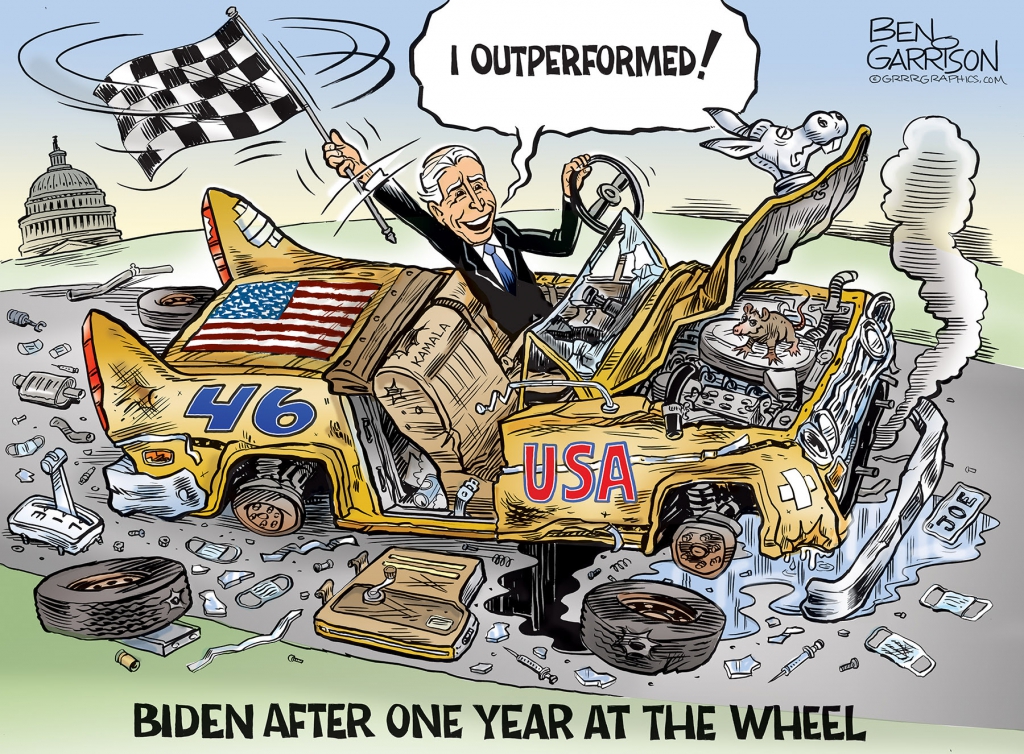

The deficit has decreased under Biden & Harris.Say what?? (You're kidding, right?)Originally Posted by adav8s28

Please take a look at my post from March 21st and see if you can tell me with a straight face that Joey and Kamala have "reduced the deficit!"

https://eccie.net/showpost.php?p=106...postcount=1665

...The main reasons for inflation were two things: Supply chain problems caused by Trump mishandling the Pandemic and Putin invading the Ukraine. Originally Posted by adav8s28Really? Most people I know seem to think the primary driver of the big 18-month burst of high inflation was the tsunami of government spending, which was well in excess of what may reasonably have been considered appropriate for getting us through the aftermath of the covid crisis. Remember, not long after the year 2021 dawned, businesses were re-opening, the economy was getting back on track, and people were returning to work by the millions. We didn't need to have nearly $2.5 trillion of excess savings poured into household bank accounts. Even economist Larry Summers, a partisan Democrat, said that the "American Rescue Plan" was the most irresponsible fiscal act in decades, and would create a nasty inflation spike. And as if that weren't more than enough, the big spenders piled on hundreds of billions more in unpaid-for and unnecessary spending in short order.

Trumps tax cut for the 1% caused the Federal Budget deficit to go up. Originally Posted by adav8s28Are you somehow unaware that only a small portion of the 2017 tax cut went to "the 1%?" (The bulk of the tax cut dollars reduced the burden on taxpayers in the lower income brackets, not the "wealthy." Didn't we already go over that in this thread?)

And now we are still stuck in a surreal place where Joey promises that no one earning less than $400K annually will see a tax increase.

(Which is tantamount to saying that he isn't even going to bother to make the slightest pretense of credibly claiming that we're going to attempt to pay for all the shit that was crammed through during the first couple of months of his shockingly irresponsible administration, let alone any of the new stuff comprising the progressives' wish list encompassed within his new $7.3 trillion budget fantasy.)