A philosopher king might say: Luckily, when the mighty fall, there are plenty of little people to cushion the landing.

Was reading a recent interview with The Bernanke, hoping to catch a glimpse of what a soft landing might be like in our future. Decent interview (short too)

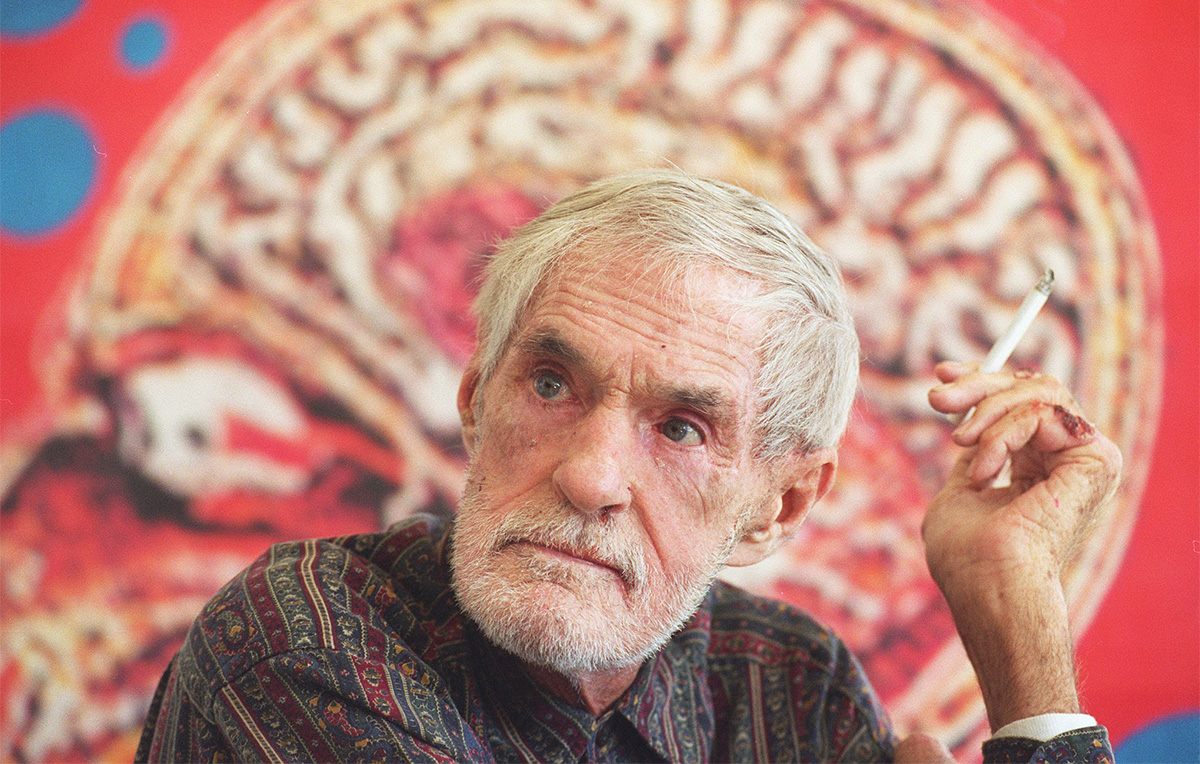

Former Chair Ben Bernanke takes long view of Federal Reserve’s current challenges

...

Ryssdal: So let me ask you that just as a way to wrap it up. You know, you talk about how blunt the Fed’s instruments are. Powell talks about it all the time, I’m sure we can find Chair Yellen saying it. But you’ve just recited a bunch of tools the Fed kind of created and did in a time of crisis. Is it unreasonable for the public to expect that, you all being smart economists, can figure out a way to more acutely fix things like inflation, other than just “Oh, my goodness, all we’ve got is the federal funds rate and the balance sheet and forward guidance?”

Bernanke: Well, the Fed can be creative, but it has to stay within its legal powers and within the remit that Congress has given it. So it can’t do much, frankly, and unfortunately about say, big increases in oil prices globally or big increases in food prices. It can’t fix supply chains or eliminate COVID. The Fed has got powerful tools in one area, which is that it can cool demand, which in turn will take some of the pressure off inflation. And as a result, how much inflation comes down over the next year or two, it’s going to depend partly on the Fed’s policies and how aggressive they are. It’s also gonna depend on a bunch of things that the Fed and the government in general just don’t really control, like oil prices and like supply chains.

...

My take-away reminded me of the movie Apollo 13, staring Tom Hanks. In particular the scene where they have to make their last course correction before reentry without instruments and he just sort of eyeballs it. From my days in that business, there was only one correct answer versus 1,000,000+ answers that they could burn up by coming in too steep and 1,000,000+ answers that would cause them to skip off of the atmosphere and heads towards Alpha Centuri.

God's speed Apollo 13. Failure is not an option.

My take is that this guy approaches the issue from an angle different from mine (largely a technical analysis view rather than my fundamental analysis viewpoints).

Nonetheless, I think he's right that AAPL is more richly priced that warranted and I've believed for some time that its salad days are mostly in the past. The stock is so widely held and widely followed that it's likely a better market bellwether than almost any other issue. (And still has a $2+ trillion market cap!)

So my view is that AAPL is overvalued and more likely than not to decline more than the S&P in a possible recession-induced bear market.

.

Originally Posted by CaptainMidnight

PS: Sorry for quoting the wrong citation of yours Captain. I meant to launch from your post #238 in his atmosphere.

PSS: Because I'm hoping this economics extrication is more like rocket science than beer pong, though the latter feels more likely ATM.

What a startling revelation!

What a startling revelation!