Pound that RTM button

In the meantime

https://www.cbsnews.com/news/could-t...news-explains/

- HDGristle

- 03-16-2022, 02:36 PM

- berryberry

- 03-16-2022, 05:22 PM

Democrats Don’t Want You To Know How Much Fossil Fuel It Takes To Power Electric Cars

Amid inflationary U.S. federal spending, restrictions on domestic oil production, and the current Russia-Ukraine conflict, millions of Americans are suffering the consequences of the Biden administration’s dysfunction at the gas pump.

Instead of investing in American energy, Democrats are actively suppressing the American energy industry and then telling Americans to spend their savings on overpriced electric cars to solve their problems. But the left isn’t being honest about the environmental and financial costs of those trendy electric vehicles.

To advance their climate agenda and deflect backlash about rising gas prices, Democrats are telling Americans that driving electric cars is for the greater good of the environment, fully knowing the charging stations for these cars are not fossil fuel free.

In reality, one of Tesla’s Supercharger stations was reported to get 13 percent of their energy from natural gas and 27 percent from coal. Power plants burn coal to generate electricity to power electric cars and emit a higher fossil fuel footprint than the left would care to admit.

While these vehicles may be falsely advertised, many who invest in these overpriced cars are able to avoid paying the currently outrageous gas prices. Still, Americans’ growing reliance on electric cars and the batteries they require will increase our dependence on countries such as China for materials.

“Chinese companies, particularly CATL, have secured vast supplies of the raw materials that go inside the batteries,” The New York Times reported in December. “That dominance has stirred fears in Washington that Detroit could someday be rendered obsolete, and that Beijing could control American driving in the 21st century the way that oil-producing nations sometimes could in the 20th.”

By increasing our use of electric cars, the United States will require more lithium batteries and will further rely on China to sustain our supply. While the current energy crisis could be an opportunity for America to increase our energy independence, the current administration refuses to take advantage

As The Federalist’s Tristan Justice reported in August, Biden’s electric vehicle plan “is a big win for Beijing.” Despite our capability to become independent and profit from American-made energy, Biden has no plans to trump China’s mass energy production, even as China continues to flaunt the rigid “green” standards that hold our own producers back.

As long as the United States continues to outsource production and jobs to China, it will be hardworking Americans who suffer the economic consequences of our energy dependence.

https://thefederalist.com/2022/03/16...electric-cars/

Amid inflationary U.S. federal spending, restrictions on domestic oil production, and the current Russia-Ukraine conflict, millions of Americans are suffering the consequences of the Biden administration’s dysfunction at the gas pump.

Instead of investing in American energy, Democrats are actively suppressing the American energy industry and then telling Americans to spend their savings on overpriced electric cars to solve their problems. But the left isn’t being honest about the environmental and financial costs of those trendy electric vehicles.

To advance their climate agenda and deflect backlash about rising gas prices, Democrats are telling Americans that driving electric cars is for the greater good of the environment, fully knowing the charging stations for these cars are not fossil fuel free.

In reality, one of Tesla’s Supercharger stations was reported to get 13 percent of their energy from natural gas and 27 percent from coal. Power plants burn coal to generate electricity to power electric cars and emit a higher fossil fuel footprint than the left would care to admit.

While these vehicles may be falsely advertised, many who invest in these overpriced cars are able to avoid paying the currently outrageous gas prices. Still, Americans’ growing reliance on electric cars and the batteries they require will increase our dependence on countries such as China for materials.

“Chinese companies, particularly CATL, have secured vast supplies of the raw materials that go inside the batteries,” The New York Times reported in December. “That dominance has stirred fears in Washington that Detroit could someday be rendered obsolete, and that Beijing could control American driving in the 21st century the way that oil-producing nations sometimes could in the 20th.”

By increasing our use of electric cars, the United States will require more lithium batteries and will further rely on China to sustain our supply. While the current energy crisis could be an opportunity for America to increase our energy independence, the current administration refuses to take advantage

As The Federalist’s Tristan Justice reported in August, Biden’s electric vehicle plan “is a big win for Beijing.” Despite our capability to become independent and profit from American-made energy, Biden has no plans to trump China’s mass energy production, even as China continues to flaunt the rigid “green” standards that hold our own producers back.

As long as the United States continues to outsource production and jobs to China, it will be hardworking Americans who suffer the economic consequences of our energy dependence.

https://thefederalist.com/2022/03/16...electric-cars/

- bambino

- 03-16-2022, 07:18 PM

Enjoy those penny savings Mr Gristle while you can;

https://www.nytimes.com/2022/03/16/b...emand.amp.html

https://www.nytimes.com/2022/03/16/b...emand.amp.html

- HDGristle

- 03-16-2022, 08:06 PM

North Dakota producers not adding investment despite high oil pricesSeems there's blame abound. A bit of everything for everyone here, hence my point. But, by all means let's call it misinformation.

2h ago

Star Tribune

Even with petroleum prices rocketing in recent weeks, oilfield operators did not add any new drill rigs in North Dakota.

Nationwide, the drill rig count — a key indicator of new oil production — has risen, but it’s still nowhere near its pre-pandemic level.

"It makes you a little a curious as to why our largest oil and gas companies are not ramping up," Lynn Helms, North Dakota’s mineral resources director, said Tuesday during a monthly call with reporters.

With war in Ukraine, West Texas Intermediate — the benchmark U.S. crude price — topped $130 a barrel last week before falling back to Earth in recent days, settling Tuesday around $95 a barrel.

Helms said he expects oil prices to range from $95 a barrel to $125 a barrel "on any given day." That should translate into gasoline prices of $3.50 to $4 per gallon in the Midwest, he added.

North Dakota released its January oil production numbers Tuesday, and they were grim. Output fell 5 % from the previous month to 1.09 million barrels per day, the most significant drop since COVID-19 hit in 2020, Helms said. Natural gas production fell 7%.

Particularly cold weather was to blame in January, which gummed up machinery, he said.

There were far broader problems, though. North Dakota’s rig count currently stands at 33 — and has barely moved for several months. The rig count was in the mid-50s prior to the pandemic.

Yet WTI was trading above $70 per barrel for most of the past six months — well above the break-even price in North Dakota and other U.S. shale oil regions.

The Biden administration has even tried to cajole U.S. oil companies to boost production.

Last week, at an annual energy conference in Houston known as CERAWeek, U.S. Energy Secretary Jennifer Granholm said the country was on a "war footing" and that oil and natural gas production needed to rise.

At that same conference, several oil company executives contended that the oil market wouldn’t be so tight had the federal government been more supportive of the industry, Reuters reported.

Helms said oil company executives have told him that the Biden administration is reducing their appetite for new investment risk. Their outlook: "Long term, this administration doesn’t want your business," Helms said.

Shale drillers, who dominate U.S. production, have been particularly irked by the Biden administration’s moratorium on new oil and gas leases on federal land. "The total number of leases is really low," Helms said.

Federal lands, though, account for only 24% of U.S. oil output, according to a 2018 report from the Congressional Research Service.

Thousands of potentially productive leases are essentially being inventoried by oil producers. The shale oil industry’s reticence to drill reflects a newfound financial discipline.

For years, publicly traded shale companies expanded production non-strategically as oil prices rose, only to see shareholder disasters — like cascading losses and bankruptcies — during market pullbacks.

Energy stocks were one of the worst equity investments for much of the past decade.

Rebuked by investors, shale companies since COVID have been eschewing rapid expansion in favor of returning cash to shareholders. With high oil prices, they’re raking in profits.

The executives of two major shale oil companies — Pioneer Natural Resources and Devon Energy — signaled last month during earnings conference calls that they intend to remain disciplined.

"I want to be clear that there is no change to our cash return playbook," Devon CEO Rick Muncrief told stock analysts. Pioneer CEO Scott Sheffield told analysts, "We’re not going to let the growth rate jump."

In October, Sheffield told the Financial Times that even if prices topped $100 a barrel, frackers would be cautious. "All the shareholders that I’ve talked to said that if anybody goes back to growth, they will punish those companies," he said.

After COVID caused shutdowns in the U.S. in March 2020, global oil demand cratered as factories cut back production and motor vehicle drivers stayed home. WTI stayed below $50 a barrel for much of 2020.

But over the past year, demand for oil has outpaced the industry’s output. OPEC and other oil exporting nations — who control over half the world’s supply — have been disciplined, too.

And like many industries, the oil business faces a tight supply chain for oilfield equipment and other supplies. Plus, oil companies been scrambling to find workers, another disincentive for production, Helms said.

"We have seen a lot of pressure on fracking crews," he said.

©2022 StarTribune. Visit at startribune.com. Distributed by Tribune Content Agency, LLC

- berryberry

- 03-16-2022, 10:17 PM

Buy a Tesla - or ride a bus. That is what the idiots like Buttplug Pete in the Biden Admin think of you and the price of gas

WATCH: Buttigieg says the solution to high gas prices is “public transportation.”

https://twitter.com/i/status/1504202989208285191

WATCH: Buttigieg says the solution to high gas prices is “public transportation.”

https://twitter.com/i/status/1504202989208285191

- HDGristle

- 03-17-2022, 05:07 AM

3/17/22 morning avg gas price in Pgh according to AAA

4.314 for regular. Down 0.006 from yesterday. 5th day in a row of slight downward movement

4.314 for regular. Down 0.006 from yesterday. 5th day in a row of slight downward movement

- berryberry

- 03-17-2022, 07:33 AM

Buy a Tesla - or ride a bus. That is what the idiots like Buttplug Pete in the Biden Admin think of you and the price of gasThe White House policy staff is filled with people who have lived exclusively in the digital and symbolic world. They act as if physical things just appear at gas stations and Walmart distribution centers. If they get the words right, perception and reality will follow. Buttigieg is a good indicator: during the worst supply chain crisis in recent history, he was taking paternity leave, promoting eco-friendly bike lanes, and declaring that roads are racist. Equal parts narcissism and delusion.

WATCH: Buttigieg says the solution to high gas prices is “public transportation.”

https://twitter.com/i/status/1504202989208285191 Originally Posted by berryberry

Now this bullshit after thanks to their policies gas prices under Senile Biden nearly doubled

- berryberry

- 03-17-2022, 07:55 AM

Yet all the bullshit you guys have been yodeling about the keystone Pipeline has only 14% of support in the US. Hmm. So, the ruse off the FOX news team of 900k barrels (inflated figure btw) is not accurately representing the will of Americans. Originally Posted by eyecu2Remember this whopping piece of misinformation Eye posted a few days ago? The one where I called him out with

There you go spreading more misinformation. No wonder you have no credibility here. There is nothing in the Trafalgar poll link I posted that talks about the Keystone Pipeline.Well this just goes to show you how much he lied.

Poll: 71% of Americans Favor Biden Restarting Keystone XL Pipeline

High gas prices in the United States and now the banning of Russian oil imports following Vladimir Putin’s invasion of Ukraine are causing Americans to favor domestic energy production, including a poll that shows 71 percent “favor very much” or “favor somewhat” restarting the Keystone XL Pipeline.

Yep - that is right. 71% SUPPORT restarting the Keystone Pipeline, not the BS 14% number he made up. This is just one example of the type of misinformation he posts to cover up for Senile Biden and the libtards.

https://www.breitbart.com/politics/2...e-xl-pipeline/

- bambino

- 03-17-2022, 08:09 AM

- HDGristle

- 03-17-2022, 08:15 AM

It's interesting that you and others keep focusing on domestic energy production and keep bringing up XL, which primarily supports Canadian energy production.

For a capacity volume that accounts for 1-3% of the crude processed by U.S. refineries, of which the majority of the oil from XL would be Canadian imports since it was what, 70-75% skewed for Canadian tar sand oil vs the U.S. crude that would have entered at the U.S. intake? And which would have had an absolutely negligible impact on the global price of crude oil and by extension the price of gas at the pump?

For a capacity volume that accounts for 1-3% of the crude processed by U.S. refineries, of which the majority of the oil from XL would be Canadian imports since it was what, 70-75% skewed for Canadian tar sand oil vs the U.S. crude that would have entered at the U.S. intake? And which would have had an absolutely negligible impact on the global price of crude oil and by extension the price of gas at the pump?

- berryberry

- 03-17-2022, 09:04 AM

Well after Senile Biden's attempt to blame Putin for the Biden induced high price of gas fell flat on its face, now Senile Biden is saying its a conspiracy of big oil companies

Senile Biden refuses to take responsibility for his colossal fuck ups

Biden's Vast Oil Conspiracy

The President takes to Twitter to show what he doesn’t know about the retail gasoline market.

https://www.wsj.com/articles/joe-bid...s-11647468748?

Senile Biden refuses to take responsibility for his colossal fuck ups

Biden's Vast Oil Conspiracy

The President takes to Twitter to show what he doesn’t know about the retail gasoline market.

https://www.wsj.com/articles/joe-bid...s-11647468748?

- berryberry

- 03-17-2022, 09:22 AM

House Dems block energy independence bill; GOP energy expert slams move as 'unconscionable'

House Democrats on Wednesday blocked consideration of a Republican bill aiming for U.S. energy independence from Russia amid the Ukraine war. A former environmental engineer now running for Congress in New Mexico condemned the move as "unconscionable" in comments to Fox News Digital.

"House Dems just voted against a measure by [House Republicans] to consider the American Energy Independence from Russia Act -- a critical bill that would unleash American energy production," Rep. Stephanie Bice, R-Okla., tweeted Wednesday. "Clearly, Dems don't care about solving our crushing energy crisis. Unbelievable!"

https://www.foxnews.com/politics/hou...unconscionable

House Democrats on Wednesday blocked consideration of a Republican bill aiming for U.S. energy independence from Russia amid the Ukraine war. A former environmental engineer now running for Congress in New Mexico condemned the move as "unconscionable" in comments to Fox News Digital.

"House Dems just voted against a measure by [House Republicans] to consider the American Energy Independence from Russia Act -- a critical bill that would unleash American energy production," Rep. Stephanie Bice, R-Okla., tweeted Wednesday. "Clearly, Dems don't care about solving our crushing energy crisis. Unbelievable!"

https://www.foxnews.com/politics/hou...unconscionable

- HDGristle

- 03-17-2022, 09:27 AM

Ah, so now energy independence means independent of Russia.

So not Domestic Energy Independence, not North Anerican Energy Independence. Independence from Russia.

Which thing do you guys want?

So not Domestic Energy Independence, not North Anerican Energy Independence. Independence from Russia.

Which thing do you guys want?

- Jacuzzme

- 03-17-2022, 09:36 AM

Rep. Stephanie Bice, R-Okla., tweeted Wednesday. "Clearly, Dems don't care about solving our crushing energy crisis. Unbelievable!"Rep. Stephanie Bice, R-Okla. is just figuring this out? Dems WANT an energy disaster so their green bs seems more palatable, and have for years. Plenty of them on record, including Obonga, saying exactly that.

- berryberry

- 03-17-2022, 10:31 AM

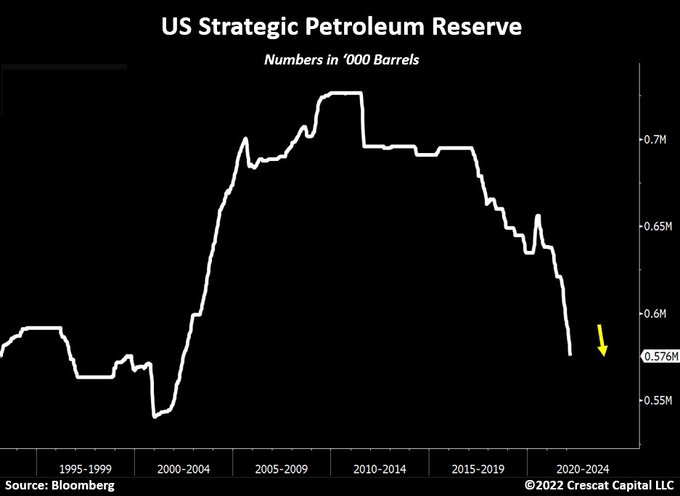

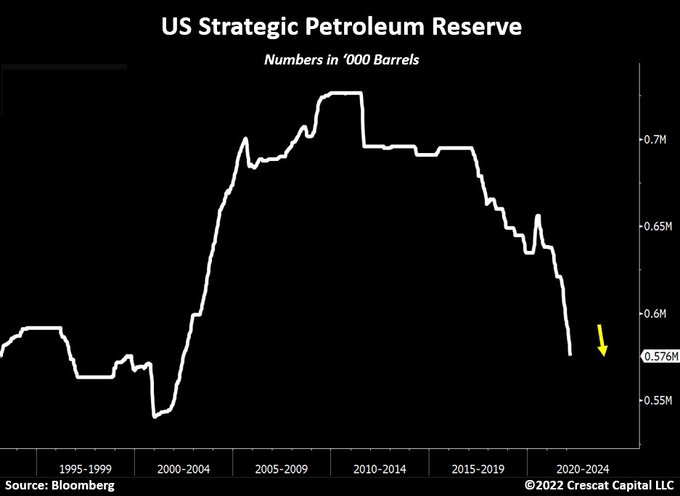

The US continues to dump its Strategic Petroleum Reserve like there is no tomorrow.

The government is now down to 33 days worth of oil supply at its current implied demand.

That is one of its lowest levels in history.

The government is now down to 33 days worth of oil supply at its current implied demand.

That is one of its lowest levels in history.