If we are ever going to correct this serious imbalance, then we need to be promoting our nation's exports and exporters as much as possible, not cutting off funds for one of the few US government entities operating under such a mission. I read the Daily Beast story trying to figure out what is so objectionable about the US Eximbank, which I always viewed as a boring, non-partisan backwater trade-boosting arm. I still have no idea how (after all these years) it suddenly became a poster child for crony capitalism.Although not unalterably opposed to Ex-Im in principle, I believe that its benefits should flow exclusively -- or nearly exclusively -- to less well-financed firms whose access to international markets is relatively difficult. It's my view that large, well-financed outfits such as GE aren't engaged in activities that need to be subsidized in any way -- especially in this day of a pancaked yield curve allowing them to borrow almost unlimited funds at near zero interest. Yet corruption within the political process and their cozy connections to the corridors of power mean that that's exactly what happens, and that therefore resources that would otherwise be available to boost the potential of smaller firms get crowded out. And I'm skeptical of the view that the disappearance of Ex-Im involvement would cost the Boeings and GEs of the world so much as a dollar's worth of lost sales. Hence, I see Ex-Im as just another crony capitalist shuffle, although I certainly agree that it's not something that's at the top of the list of things that need to be fundamentally reformed, fixed, or eliminated. (That's indeed a long, fat list!)

The author claims that Eximbank loans and loan guarantees are tantamount to “export credit subsidies (that) will never raise the overall level of trade”. Really? So all the Eximbank-financed trade would have occurred anyway without its help? I call bullshit on that one. She never quantifies how much taxpayer money has been spent on the subsidies or what they consist of either. Are the loans made at below-market interest rates? Do they have a high default rate? Does the bank generate a profit? How much money are we talking about anyway? She mentions current legislation to raise the Eximbank's lending authority by $20 billion over 7 years. That's chump change! Total US exports in 2014 alone were over $1.6 trillion.

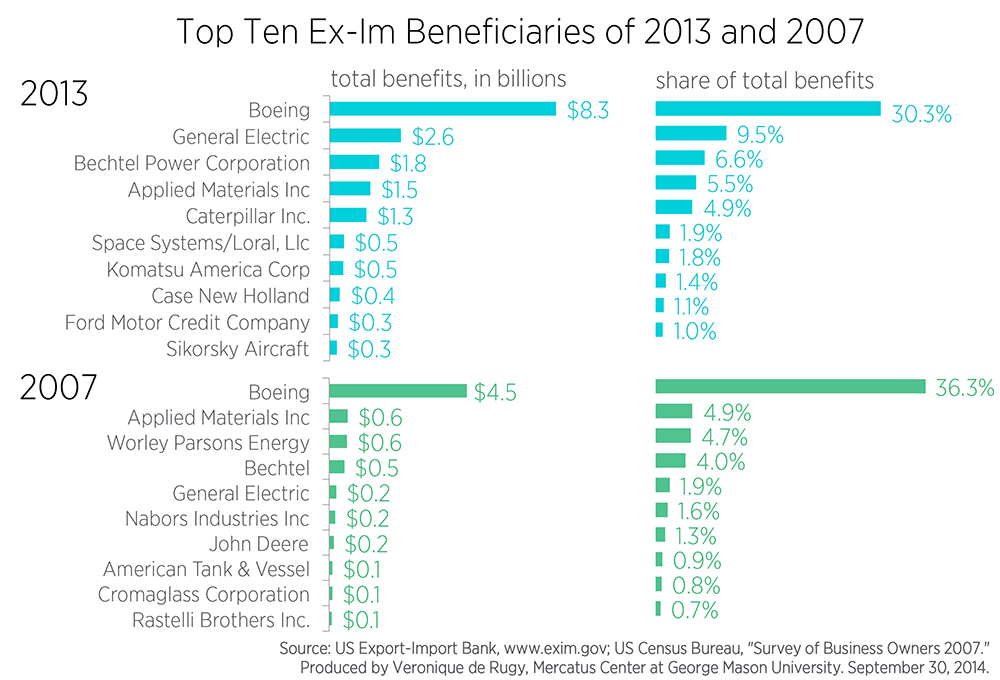

The author complains that 64% of Eximbank's loans benefit 10 large US companies. She mentions Boeing, GE and Caterpillar. What a SHOCK to learn that an agency tasked with boosting our nation's exports is working primarily with some of our largest exporters! Duh! Look, I am all in favor of teaching smaller US firms how to tap overseas markets and I'm pretty sure Eximbank tries to help them too. But you can't tell me they are being disadvantaged because Eximbank helps Boeing beat out Airbus on a sale, or works with GE against Siemens, or lets Caterpillar win a bid against Komatsu. I'm just happy we still know how to build a few things the world wants - like airliners, tractors and turbines. We're competing against a lot of other countries that subsidize the hell out of their exports. We can either file complaints with the WTO and lose a ton of business waiting 4 years for a ruling - or we can level the playing field with our own modest export assistance programs.

None of this means I am not in favor of reforming how Eximbank does business, making it more effective or telling it to devote more resources to small US companies that need to be educated about export opportunities. But IMO, out of all the parts of the federal government that are wasting our money and pissing away our tax dollars, it's not even in the top 30. Originally Posted by lustylad

I appreciate your comments, but am afraid we'll just have to agree to disagree here. I'm with Ms. de Rugy on this one.

.