this has been posted in this forum at least 6 times by various posters ...Iím trying to get back on topic which is.

IRS data proves Trump tax cuts benefited middle, working-class Americans most

https://www.yahoo.com/news/irs-data-...ycsrp_catchall

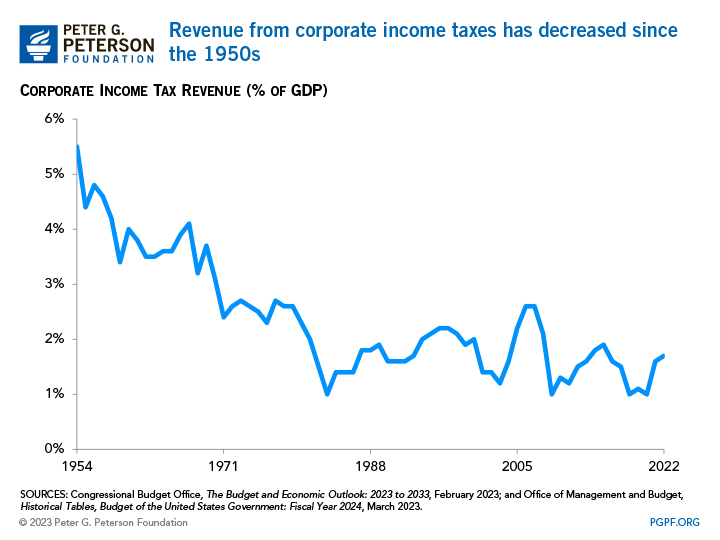

since 2017 corp tax revenue has gone up. Originally Posted by The_Waco_Kid

Kamala's new policy AD: Opportunity Economy

If you want to debate Tax policy feel free to open a new thread and Iíll be happy to post there.