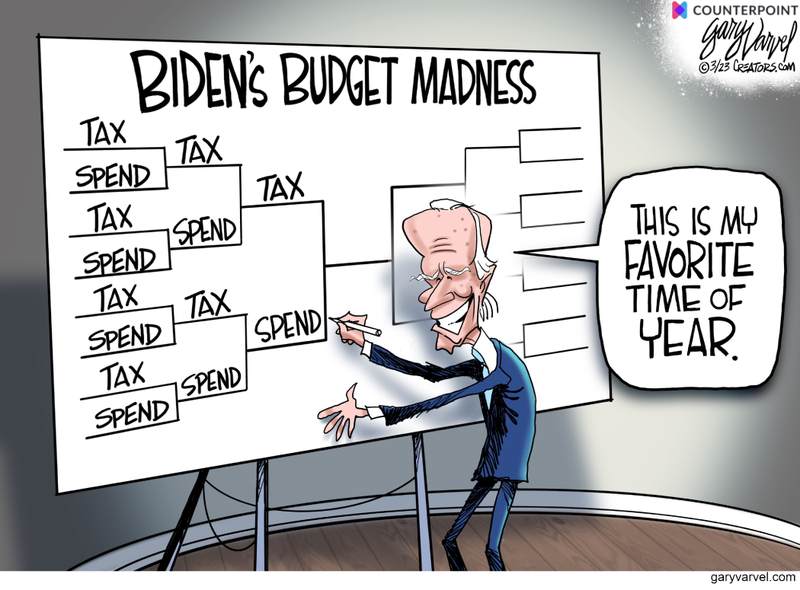

Yeah! That's the ticket!...MOAR!!

MOAR Taxes! -- MOAR Spending! -- MOAR Debt!

MOAR, MOAR, MOAR! Hell yeah!Originally Posted by Why_Yes_I_Do

Where should one start? Well, I'll give it a shot!

First, there's the proposed increase in the corporate tax rate from the current 21% to 28%. Did progressives forget that the pre-2017 tax code shackled the economy with significant deadweight loss by incentivizing the corporate inversions of the mid-'10s?

Quick explainer of deadweight loss:

https://taxfoundation.org/deadweight...igh-tax-rates/

Do we really want to shackle American firms with a tax code that renders them less competitive relative to overseas players? Imposing a rate higher than the OECD average would do just that.

Now we are at least close to being competitive, though there's still room for improvement:

https://taxfoundation.org/us-effecti...te-oecd-peers/

Second, there's the proposed near-doubling of the capital gains tax rate from the current 23.8% to a whopping 44.6%. (At that rate, who in the hell would ever sell anything unless virtually forced?!!) That humongous hike would cost the Treasury a great deal of money, not raise more revenue.

Third, and possibly even worse, is the proposed tax on unrealized capital gains. Among other destructive effects, that would chase huge amounts of capital out of the publicly traded markets and into private equity, which would obviously make it a lot more difficult for the taxing authorities to assess valuations. Since non-wealthy individuals own or have beneficial interests in the publicly-traded markets either directly or in 401(k) or other pension or retirement plans, and do not own much in the way of interests in private equity, how in the world can a progressive support such nonsense? This would increase wealth inequality, not ameliorate it.

Taken together, all of these proposals would raise little or no revenue -- and would likely cost the Treasury -- while increasing wealth inequality and impeding prospects for economic growth in the '20s by shackling the economy with significant additional deadweight loss.

Bad economic policy, please meet Mr. Real World.

Caution: Mr. World is a real badass. In fact, he's the undefeated heavyweight champion of the world!