The point is that we can have similar convos about each of the staples in the CPI bucket. And there will be varying levels of things that the current admin can and can't do to address them. Or didn't do.Don't quit your day job. You're clearly not an economist. You just spent half a page bloviating to make a simple point nobody is contesting - namely that inflation has multiple causes, some of which are not readily fixable by government.

That the Fed can and can't do. Or didn't.

That are setup by previous administration policies.

That depend on public and private business decisions.

The average person doesn't scratch the surface of understanding inflationary drivers. On avg, blame is assigned to whoever is in charge at that moment when things go poorly. Praise is assigned to whoever is in charge at that moment when things go right. But they don't get there in a vacuum. Not everything can be just be handwaved and/or blamed on Democrat spending. Or people notnworking because of stimulus funds. Or COVID restrictions. Or the current guy. Or even the last guy.

But that's what we do because it's easy to not be informed. The media, left and right, are great at obfuscating, praising folks for shit they had little to do with and scapegoating for the same for their respective set of lemmings.

When we boil things down to "Are you better off today than you were 4 years ago?" we are purposely divorcing ourselves of context to focus on the surface level. I'm vastly more well off today than I was 4 years ago and compared to last year inflation included. I know many aren't.

Any time we pull a snapshot on inflation we need to understand the context of not just what happened from point F to point G, but go back further to understand the context of how we got to point F.

But if we only look at it through political lenses, driven by long-standing media strategies to take advantage of our cognitive dissonance and low levels curiosity then I guess we aren't as smart as we pretend to be when bashing the other side. Originally Posted by HDGristle

I don't want the government to approach the problem of generally rising prices by tediously analyzing the drivers behind each fucking component of the CPI, like oranges, cars, rent, etc. When prices are heating up ACROSS THE BOARD, any economist worth his/her salt will tell you it's a MACRO problem, not a MICRO phenomenon. And the first thing you should do to cure it is to switch to more restrictive MACRO policies, on both the fiscal and monetary levels. That means, inter alia, you curtail spending and raise interest rates. Do you see Biden pushing for anything remotely close to that? Or the dim-retards in Congress, who are now trying to put together yet ANOTHER wasteful spending program after we've shoveled out $5.7 trillion in emergency "relief" since the pandemic started?

I'm old enough to have lived through previous inflationary periods, and yes the problem may be exacerbated by factors that are beyond the control of a single President. For example, it would be hard to blame Nixon for the 1973 Arab oil embargo and subsequent quadrupling of world oil prices. But every inflationary spiral is different, and I can tick off at least a dozen Biden policy decisions that have stupidly and recklessly worsened the problem rather than alleviated it. In previous episodes, it took years for inflation to accelerate to double digit levels. This time around, we're on track to set a fucking record. Kinda like that new Corvette EV that can go from zero to 60 in 3.4 seconds.

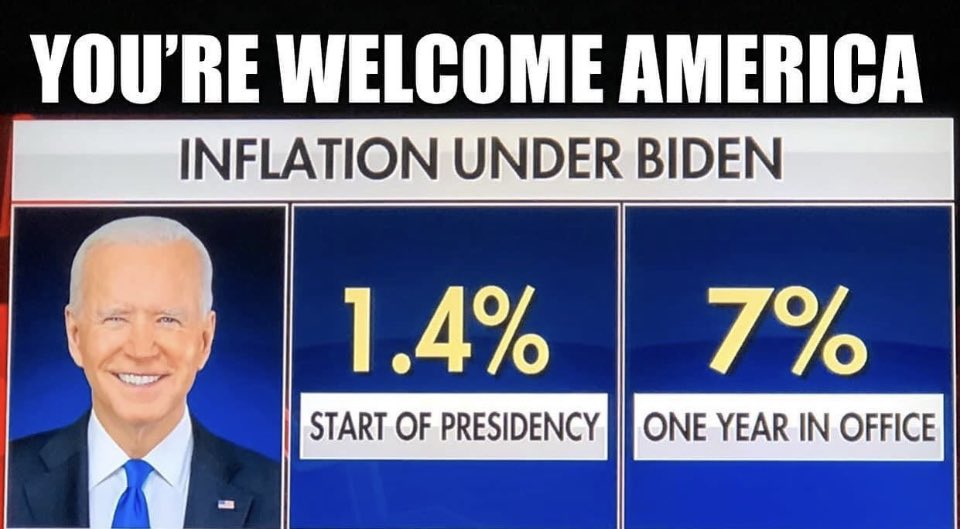

The CPI has soared by 7.5% in the past 12 months, after rising by only 1.4% in all of 2020. That means inflation has more than quintupled in a year! A spike as dramatic as that can't happen without the government opening up the fiscal and monetary spigots for it! So while you're busy wracking your brain to come up with excuses, the rest of us will just shake our heads and say "Heckuva job, Joey!"

Ever study Keynes? Probably not. Here are two of his quotes that you and Joey would do well to ponder:

1. "There is no subtler, no surer means of overturning the existing basis of Society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose."

From The Economic Consequences of the Peace, 1919

2. "The boom, not the slump, is the right time for austerity."

From The General Theory of Employment, Interest and Money, 1936

If we wanted to solve the chip crisis we have today, when did it start? Why does most of the world get them from one place? Where do we get the materials? Where would we build the plants? What kind of workers do we need? What would the lead time be on getting this up and running? What's the projection on how long it would take to get them cranking out at full capacity? How long until we had supply under control? Why wasn't something done to shore this up before? What's being done now? Why isn't it solved yet?Been there, done that. I even posted a lengthy explanation from the WSJ right here in the sandbox. You must've missed it:

That chip shortage has been a fucking killer headwind for our economy and the global economy at large. Would you care to discuss it and the impacts of it on inflation, lusty? Originally Posted by HDGristle

https://www.eccie.net/showpost.php?p...96&postcount=4

Originally Posted by berryberry

Originally Posted by berryberry