You have some serious problems Rey, just come out of the closet for Gods sake. You are a straight up homosexual. Its ok, free yourself Originally Posted by themysticWhat's that YOU say, ya LYING Liberal FUDGE PACKEE ? We all know that we can defer to YOU when it comes to " all things gay " !!! Wave that rainbow flag !

- Rey Lengua

- 03-02-2018, 10:19 AM

- WTF

- 03-02-2018, 02:16 PM

You have some serious problems Rey, just come out of the closet for Gods sake. You are a straight up homosexual. Its ok, free yourself Originally Posted by themystic

What's that YOU say, ! Originally Posted by Rey LenguaGay Rey, that is what everybody says that has read over two posts by you.

That and they can not believe someone so stupid would post daily for the world to see.

- garhkal

- 03-02-2018, 03:44 PM

When it was announced last year that Trump would look into withholding Federal grant money to sanctuary cities, the LYING LIBS cried "foul " and the state of Mexifornia hired crooked weasel Eric Holder on an expensive retainer to help them fight against those actions. Originally Posted by Rey LenguaAnd that sessions caved INTO commiefornia, and effectively ended his attempt to do that, shows sessions is spineless..

What does that have to do with anything? So you think they can break any law they want without consequence? Originally Posted by BudmanAnd do we know for actuality, that Commiefornia pays more in taxes, than federal monies they get?? You'd think with all the FEMA and other aid sent there cause of all the mudslides, forest fires etc, they'd be getting MORE in federal monies than they 'pay' in taxes..

- Rey Lengua

- 03-02-2018, 03:47 PM

Gay Rey, that is what everybody says that has read over two posts by you." everyone says ". So YOU'VE surveyed " everyone " HOVEL BUILDER ? Whenever did YOU have time to do that, get YOUR "spitroast " sessions in with the GENTE, and " manage " all 3 shifts of assup's Gloryhole franchise in Houston ! LIE some more LIBERAL !

That and they can not believe someone so stupid would post daily for the world to see.

Originally Posted by WTF

- WTF

- 03-02-2018, 05:04 PM

If you'd do more researching and less thinking, you'd be better informed.

And do we know for actuality, that Commiefornia pays more in taxes, than federal monies they get?? You'd think with all the FEMA and other aid sent there cause of all the mudslides, forest fires etc, they'd be getting MORE in federal monies than they 'pay' in taxes.. Originally Posted by garhkal

- LexusLover

- 03-02-2018, 05:24 PM

When will the Mayor get indicted?

- Budman

- 03-02-2018, 06:20 PM

- garhkal

- 03-02-2018, 11:21 PM

- LexusLover

- 03-03-2018, 04:31 AM

Gay Rey, that is what everybody says that has read over two posts by you.Exactly who is "everybody" and "they"?

That and they can not believe someone so stupid would post daily for the world to see.

Originally Posted by WTF

Are you so insecure you have to falsely suggest others agree with you?

That's an insecurity in need of counseling and removal of firearms!

- LexusLover

- 03-03-2018, 04:38 AM

As long as spineless sessions is in charge of the dept of injustice, NEVER i fear. Originally Posted by garhkalI suppose that is a good reason not to appoint someone from Congress as an Attorney General. It's tough, I know, to have someone who was loyal and supportive during the elections, but they are just too "political" in their mindset to make the appropriately tough decisions that a prosecutor has to make.

It may be a misreading of Sessions, and perhaps he is just quiet about the DOJ processes. It would be better if these criminal matters were UTR until actually filed, but a wait and see approach might be appropriate. The past administration shot their mouth off prematurely, so perhaps this is a pendulum swing in the opposite direction.

Also, Sessions doesn't do the mundane, daily preparations of initiating prosecutions, and if there are some holdovers from the prior administrations doing that job it may be slow to get to his desk.

- WTF

- 03-03-2018, 11:51 AM

- Lantern2814

- 03-03-2018, 03:32 PM

Whatthefuckdoiknow must live getting slapped around daily. Is that the "men" you hire do to you while you squeal? Fact: California gets over HALF the welfare payments for the entire country. Makes sense since over 35% of the state is on public assistance. All told, they are the biggest TAKER state in the Union. They want to leave? Go ahead. We'd have billions more for states that truly need it. And the new country of Mexifornia would start life $1.6 TRILLION in the hole. To slap you some more, obstruction of governmental administration by interfering with a lawful government operation nimrod. You lose again.

- WTF

- 03-03-2018, 03:39 PM

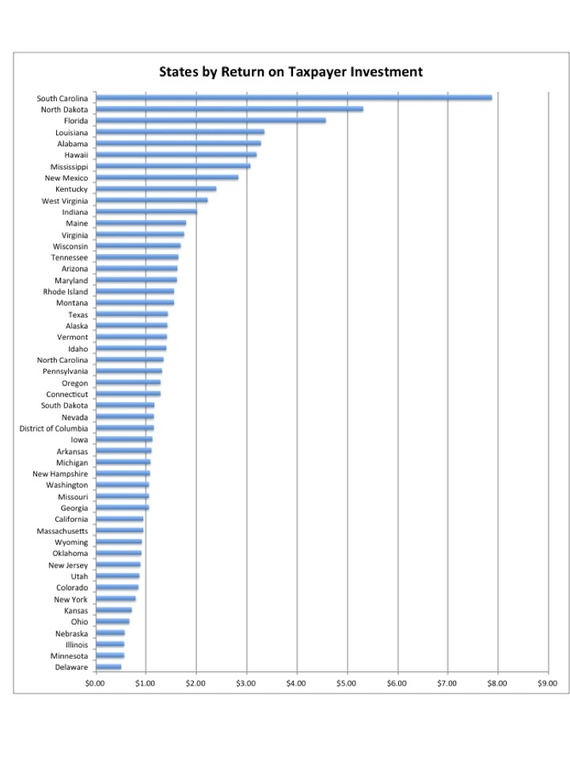

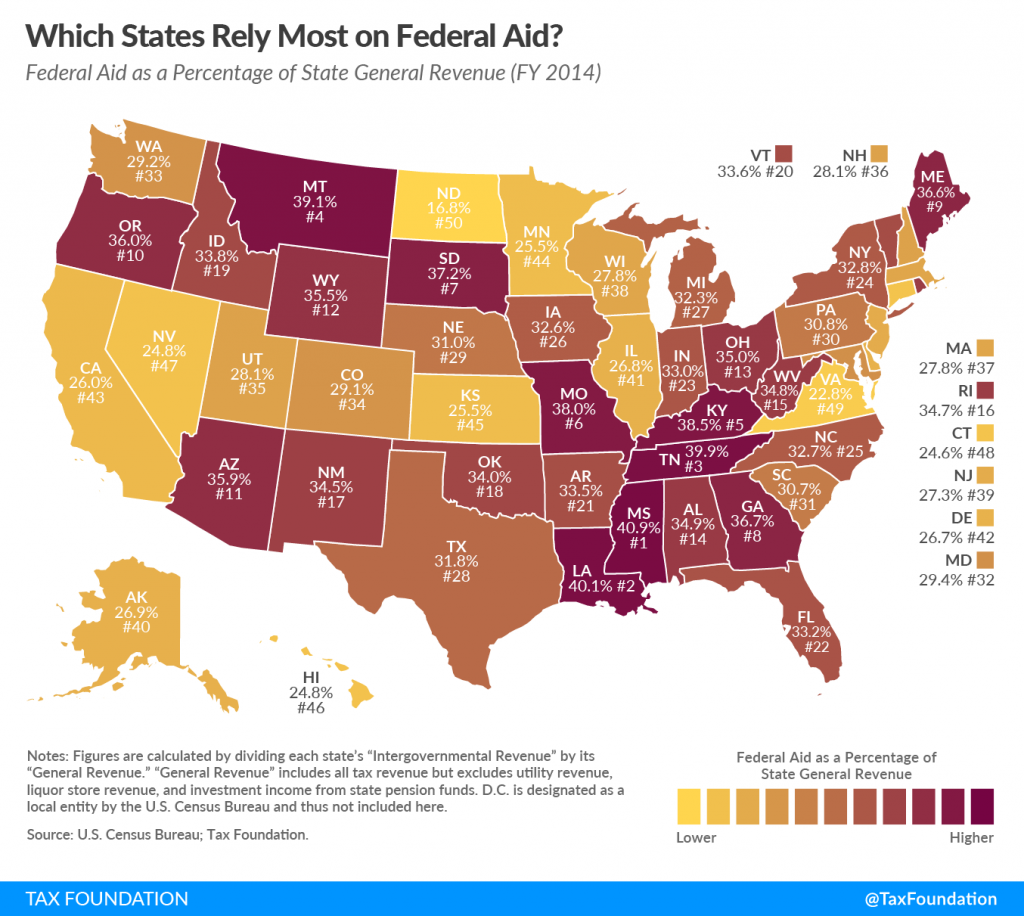

Whatthefuckdoiknow must live getting slapped around daily. Is that the "men" you hire do to you while you squeal? Fact: California gets over HALF the welfare payments for the entire country. Makes sense since over 35% of the state is on public assistance. All told, they are the biggest TAKER state in the Union. They want to leave? Go ahead. We'd have billions more for states that truly need it. And the new country of Mexifornia would start life $1.6 TRILLION in the hole. To slap you some more, obstruction of governmental administration by interfering with a lawful government operation nimrod. You lose again. Originally Posted by Lantern2814which states rely more on Federal dollars?

- WTF

- 03-03-2018, 03:43 PM

- WTF

- 03-03-2018, 03:52 PM

Cali ranks 46 in dependent on Fed money.

2017’s Most & Least Federally Dependent States

Mar 21, 2017 | John S Kiernan, Senior Writer & Editor

The extent to which the average American’s tax burden varies based on his or her state of residence represents a significant point of differentiation among state economies. But it’s only one piece of the puzzle.

What if, for example, a particular state can afford not to tax its residents at high rates because it receives disproportionately more funding from the federal government than states with apparently oppressive tax codes? That would change the narrative significantly, revealing federal dependence where bold, efficient stewardship was once thought to preside.

The idea of the American freeloader burst into the public consciousness when #47percent started trending on Twitter in 2012. And while the notion is senselessly insulting to millions of hardworking Americans, it is true that some states receive a far higher return on their federal income-tax contributions than others.

Just how pronounced is this disparity? And to what extent does it alter our perception of state and local tax rates around the country? WalletHub sought to answer those questions by comparing the 50 states in terms of three key metrics. Read on for our findings, expert commentary and a detailed methodology.

1 Main Findings 2 Red vs. Blue States 3 Correlation Analysis

4 Ask the Experts: Making Sense of Funding Disparities 5 Methodology

Main Findings

115050

50

Most Federally Dependent States

Rank

(1 = Most Dependent)

State

Total Score

‘State Residents’ Dependency’ Rank

‘State Government’s Dependency’ Rank

1Kentucky76.1665

2Mississippi75.5971

3New Mexico73.88317

4Alabama72.45414

5West Virginia68.97515

6SouthCarolina68.17231

7Montana65.91144

8Tennessee61.76203

9Maine61.02139

10Indiana59.18723

11Arizona59.081511

12Louisiana55.39402

13SouthDakota53.57247

14Missouri52.66316

15Oregon51.512310

16Georgia49.81348

17Idaho49.641919

18Vermont49.561820

19Wyoming48.802612

20Maryland48.181132

21Oklahoma47.782118

22Pennsylvania46.151730

23Alaska45.811040

24Rhode Island45.053616

25Florida43.842722

26Ohio42.254513

27Arkansas42.123821

28North Carolina41.633225

29Hawaii41.63946

30Iowa41.383326

31Wisconsin41.091638

32North Dakota40.46150

33Michigan40.433527

34NewYork37.654424

35Texas36.814228

36Washington35.323033

37Colorado35.202934

38Virginia34.431249

39Nebraska33.784729

40Utah33.282835

41NewHampshire31.113736

42Connecticut27.802248

43Massachusetts27.364637

44Nevada26.942547

45Kansas25.393945

46California25.364143

47Illinois23.964841

48New Jersey23.844939

49Minnesota23.094344

50Delaware21.325042

https://wallethub.com/edu/states-mos...vernment/2700/

2017’s Most & Least Federally Dependent States

Mar 21, 2017 | John S Kiernan, Senior Writer & Editor

The extent to which the average American’s tax burden varies based on his or her state of residence represents a significant point of differentiation among state economies. But it’s only one piece of the puzzle.

What if, for example, a particular state can afford not to tax its residents at high rates because it receives disproportionately more funding from the federal government than states with apparently oppressive tax codes? That would change the narrative significantly, revealing federal dependence where bold, efficient stewardship was once thought to preside.

The idea of the American freeloader burst into the public consciousness when #47percent started trending on Twitter in 2012. And while the notion is senselessly insulting to millions of hardworking Americans, it is true that some states receive a far higher return on their federal income-tax contributions than others.

Just how pronounced is this disparity? And to what extent does it alter our perception of state and local tax rates around the country? WalletHub sought to answer those questions by comparing the 50 states in terms of three key metrics. Read on for our findings, expert commentary and a detailed methodology.

1 Main Findings 2 Red vs. Blue States 3 Correlation Analysis

4 Ask the Experts: Making Sense of Funding Disparities 5 Methodology

Main Findings

115050

50

Most Federally Dependent States

Rank

(1 = Most Dependent)

State

Total Score

‘State Residents’ Dependency’ Rank

‘State Government’s Dependency’ Rank

1Kentucky76.1665

2Mississippi75.5971

3New Mexico73.88317

4Alabama72.45414

5West Virginia68.97515

6SouthCarolina68.17231

7Montana65.91144

8Tennessee61.76203

9Maine61.02139

10Indiana59.18723

11Arizona59.081511

12Louisiana55.39402

13SouthDakota53.57247

14Missouri52.66316

15Oregon51.512310

16Georgia49.81348

17Idaho49.641919

18Vermont49.561820

19Wyoming48.802612

20Maryland48.181132

21Oklahoma47.782118

22Pennsylvania46.151730

23Alaska45.811040

24Rhode Island45.053616

25Florida43.842722

26Ohio42.254513

27Arkansas42.123821

28North Carolina41.633225

29Hawaii41.63946

30Iowa41.383326

31Wisconsin41.091638

32North Dakota40.46150

33Michigan40.433527

34NewYork37.654424

35Texas36.814228

36Washington35.323033

37Colorado35.202934

38Virginia34.431249

39Nebraska33.784729

40Utah33.282835

41NewHampshire31.113736

42Connecticut27.802248

43Massachusetts27.364637

44Nevada26.942547

45Kansas25.393945

46California25.364143

47Illinois23.964841

48New Jersey23.844939

49Minnesota23.094344

50Delaware21.325042

https://wallethub.com/edu/states-mos...vernment/2700/