We don't need to because we are good at creating alternate options for debt holdings. Be it additional bonds, security vehicles, or another holding institution like The Federal Reserve.True.

Conventional left liberal policy is open the borders, increase the population, divide, and then hopefully conquer...the one World Government goal of theirs would certainly do the trick but they keep ignoring China while China takes over the world. Because they are so wrong with fiscal policy, kicking the can down the road and creating the smoke mirror options will continue to rule the roost. Originally Posted by DesWad

- bambino

- 12-28-2021, 06:37 PM

- Why_Yes_I_Do

- 12-28-2021, 06:41 PM

Federal debt held by the public was actually around 39% of GDP at the end of Reagan's second term... Originally Posted by TinySo... there I was, wondering what the ratio is today. Hmmm... might be approaching 80%?!? The dickens you say...

https://usafacts.org/data/topics/gov...lic-as-of-gdp/

https://fred.stlouisfed.org/series/FYGFDPUN

Yet some still wonder why the system wants to blow up Capitalism. Could it be because we're flat broke?!?

- The_Waco_Kid

- 12-28-2021, 06:46 PM

So... there I was, wondering what the ratio is today. Hmmm... might be approaching 80%?!? The dickens you say...

https://usafacts.org/data/topics/gov...lic-as-of-gdp/

https://fred.stlouisfed.org/series/FYGFDPUN

Yet some still wonder why the system wants to blow up Capitalism. It's because we're flat broke. Originally Posted by Why_Yes_I_Do

exactly. everyone in this thread would agree on two things .. Government (deliberate) overspending and the evil that is fiat currency.

one begets the other .. thus our problem.

- Why_Yes_I_Do

- 12-28-2021, 06:51 PM

...So we can re-finance the federal debt with 30 year bonds, and then inflate the hell out of the currency! Presto Change O, the debt disappears!... Originally Posted by TinyMaybe it's just me and my non-finance understandings. But uhmmm... for everyone that bagged on Reagan's trickle down economics policy, I'm skeptical that the "Presto Change O" policy is gonna be a winner. I realize Joey Bribes is in Xi's jock strap and all, but I doubt the Chinese are going to go all in and buy those bonds, because most other major countries lay in the same danged hole that we dug ourselves into. It's something of a financial mass burial site - IMHO.

- The_Waco_Kid

- 12-28-2021, 07:13 PM

Maybe it's just me and my non-finance understandings. But uhmmm... for everyone that bagged on Reagan's trickle down economics policy, I'm skeptical that the "Presto Change O" policy is gonna be a winner. I realize Joey Bribes is in Xi's jock strap and all, but I doubt the Chinese are going to go all in and buy those bonds, because most other major countries lay in the same danged hole that we dug ourselves into. It's something of a financial mass burial site - IMHO. Originally Posted by Why_Yes_I_Do

they aren't going to mass dump them as several market challenged posters have claimed either. first, they can't for bonds bought less than 1 year. those bonds cannot be sold (dumped) on the open market until they they are held over 1 year. and the yield is usually 5 to 10 years so even dumping them after one year doesn't come close to the ideal yield they were sold under. so it's a marginal gain. basically they get their money back, nothing more.

now which economy can withstand a mass short of US Treasury bonds? the US or China?

the answer is easily .. the USA. by a mile and then some. oh it would short term fuck the US in a economic and money crunch but .. it would cause a 1929 market crash in China, as they have propped up their house of cards economy based in large part by holding US Treasury notes that they exchange for dollars and use those dollars to keep their own currency from dropping like a rock. and thus their economy.

so any threat that China, one of the top three holders of US treasury foreign debt (Japan and the UK are the other two) is a paper tiger in every way.

as it stands with fiat currency in this case oddly enough a good thing .. otherwise not so much .. we'd just print up a trillion bucks and drop it off over Beijing from a C-130 and say .. "here ya go!"

BAHHHAAAAAA

- bambino

- 12-28-2021, 07:19 PM

Bankruptcy and fuck them all. The private banks, the Vatican, the Royals and China. Go fuck yourselves. I don’t want my grandkids to be slaves to those cocksuckers.

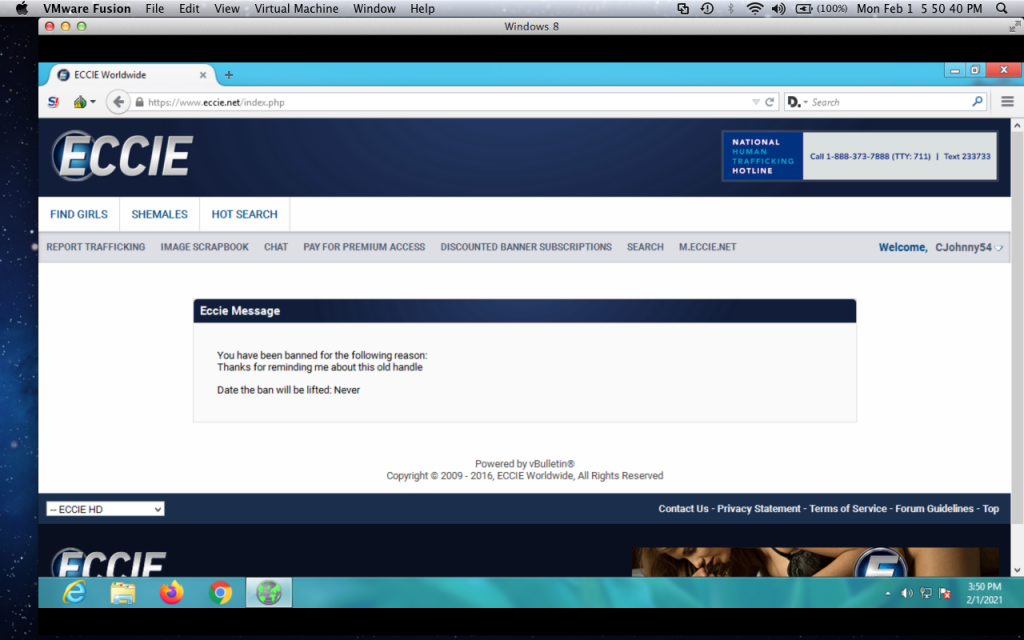

- eccieuser9500

- 12-29-2021, 07:43 PM

- bambino

- 12-29-2021, 08:30 PM

- lolhahaha

- 12-29-2021, 08:32 PM

look like you trying bump my thread, were one of your minion at home depot return lines

- The_Waco_Kid

- 12-29-2021, 08:36 PM

- lolhahaha

- 12-29-2021, 08:40 PM

what revolution chaos scam to rob.

- The_Waco_Kid

- 12-29-2021, 08:53 PM

- lolhahaha

- 12-29-2021, 09:09 PM

- The_Waco_Kid

- 12-29-2021, 09:36 PM

- dilbert firestorm

- 12-29-2021, 09:42 PM