Wtf are you babbling about now? Carter never got inflation under control. Reagan and Volcker did.

Your memory sucks. I already 'splained this to you earlier in this very thread:

Joe Biden is Jimmy Carter on steroids. When it comes to inflation, he has accelerated it much, much faster than the Georgia peanut farmer did. Biden has stoked the 12-month CPI increase from 1.4% in January 2021 to 8.5% in March 2022.

That means it's only taken the current stooge in the White House 14 short months to accelerate the annual rate of price erosion in this country by SIX-FOLD!

By comparison, even the hapless, incompetent Jimmy Carter needed four years to double it.

Heckuva job, Joey!  Originally Posted by lustylad

Originally Posted by lustylad

You almost as bad at trying to distort history as you are economics!

https://www.businessinsider.com/rona...rom%20%251%24s

HOMEPAGE

HOME POLITICS

Trump's attacks on the Fed may be intense, but they're nothing compared to a wild new story about Ronald Reagan from former Fed Chairman Paul Volcker

Bob Bryan Oct 24, 2018, 9:58 AM

Download the app

reagan volcker

President Ronald Reagan and Federal Reserve Chairman Ronald Reagan in 1981 AP

President Donald Trump's public attacks on the Federal Reserve have been eye-catching.

But a new story from former Fed Chairman Paul Volcker about President Ronald Reagan. is perhaps even more shocking.

In a new memoir, Volcker recounts being privately ordered by Reagan's chief of staff to not raise interest rates prior to the 1984 election while Reagan was in the room.

Volcker was not planning to raise interest rates at the time, but said he was "stunned" by the direct violation of the Fed's independence.

Sign up for our weekday newsletter, packed with original analysis, news, and trends — delivered right to your inbox.

Email address

By clicking ‘Sign up’, you agree to receive marketing emails from Insider as well as other partner offers and accept our Terms of Service and Privacy Policy.

President Donald Trump has come under fire recently for breaking with presidential traditions and attacking the Federal Reserve over their recent interest rate hikes.

Trump renewed the attacks on Tuesday during an interview with the Wall Street Journal, bashing Fed Chairman Jerome Powell and attacking the Fed as the "biggest risk" for the economy.

But Trump's public tantrums are nothing compared to a new recounting from former Fed Chairman Paul Volcker, who recalled intense pressure from President Ronald Reagan in the run up to the 1984 election.

In a new memoir, according to The New York Times, Volcker said he was called to the White House to meet with Reagan and Chief of Staff James Baker in the presidential library.

Volcker is best known for the "Volcker Shock," a rapid increase in interest rates in 1980 that helped tame the long-running inflation problem from the 1970s while also contributing to the

recession

that began in 1981.

It appeared that Reagan did not want a similar tightening cycle, which would have choked off economic growth, prior to his reelection campaign. According to Volcker, Reagan did not say a word, but Baker delivered a strong message.

"The president is ordering you not to raise interest rates before the election," Baker told Volcker.

Volcker did not plan on raising rates at the time, but the then-Fed chair was "stunned" since the order was an affront to the Fed's political independence. Volcker also said he later realized that the meeting was conducted in the library since there was likely no recording equipment in the room like in the Oval Office.

HOMEPAGE

HOME POLITICS

Trump's attacks on the Fed may be intense, but they're nothing compared to a wild new story about Ronald Reagan from former Fed Chairman Paul Volcker

Bob Bryan Oct 24, 2018, 9:58 AM

Download the app

reagan volcker

President Ronald Reagan and Federal Reserve Chairman Ronald Reagan in 1981 AP

President Donald Trump's public attacks on the Federal Reserve have been eye-catching.

But a new story from former Fed Chairman Paul Volcker about President Ronald Reagan. is perhaps even more shocking.

In a new memoir, Volcker recounts being privately ordered by Reagan's chief of staff to not raise interest rates prior to the 1984 election while Reagan was in the room.

Volcker was not planning to raise interest rates at the time, but said he was "stunned" by the direct violation of the Fed's independence.

Sign up for our weekday newsletter, packed with original analysis, news, and trends — delivered right to your inbox.

Email address

By clicking ‘Sign up’, you agree to receive marketing emails from Insider as well as other partner offers and accept our Terms of Service and Privacy Policy.

President Donald Trump has come under fire recently for breaking with presidential traditions and attacking the Federal Reserve over their recent interest rate hikes.

Trump renewed the attacks on Tuesday during an interview with the Wall Street Journal, bashing Fed Chairman Jerome Powell and attacking the Fed as the "biggest risk" for the economy.

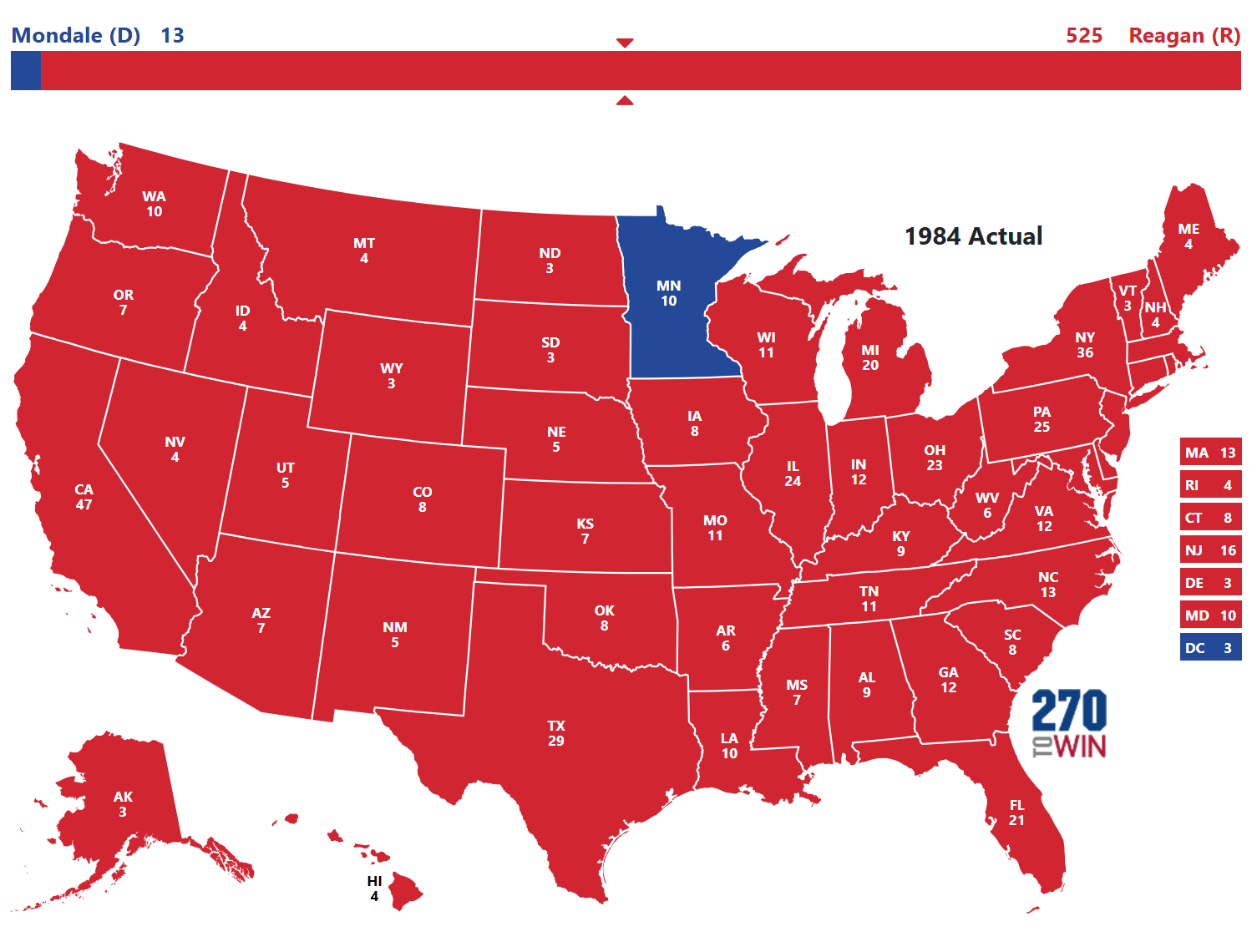

But Trump's public tantrums are nothing compared to a new recounting from former Fed Chairman Paul Volcker, who recalled intense pressure from President Ronald Reagan in the run up to the 1984 election.

In a new memoir, according to The New York Times, Volcker said he was called to the White House to meet with Reagan and Chief of Staff James Baker in the presidential library.

Volcker is best known for the "Volcker Shock," a rapid increase in interest rates in 1980 that helped tame the long-running inflation problem from the 1970s while also contributing to the

recession

that began in 1981.

It appeared that Reagan did not want a similar tightening cycle, which would have choked off economic growth, prior to his reelection campaign. According to Volcker, Reagan did not say a word, but Baker delivered a strong message.

"The president is ordering you not to raise interest rates before the election," Baker told Volcker.

Volcker did not plan on raising rates at the time, but the then-Fed chair was "stunned" since the order was an affront to the Fed's political independence. Volcker also said he later realized that the meeting was conducted in the library since there was likely no recording equipment in the room like in the Oval Office.

Reagan's apparent intimidation also echoed former President Richard Nixon's disastrous pressure on former Fed Chair Arthur Burns to keep rates low, which is seen as one of the reasons for the inflation of the 1970s.

The story also jumps out given Reagan's public reluctance to comment on Fed actions during his tenure.

For instance, when asked about Volcker's shifts during a press conference in 1982, Reagan replied: "'I can't respond to that because the

Federal Reserve

System is autonomous." In the same press conference, Reagan said there was "no way I can comment" on calls for Volcker's resignation.

Trump has complained that the Fed's current rates hikes are "loco." But while Trump's public outbursts are a break with presidential norms, the attacks have been easily dismissed by current Fed Chairman Jerome Powell. The administration had publicly maintained the respect of the Fed's independence