That which cannot go on forever, will not.

At some point the music stops and there won't be enough chairs. Matters not to me, I'm set. As for you uniparty supporters, you can all get fcuked... and you will. You will get what you deserve, good and hard. lol.

- texassapper

- 06-06-2022, 09:24 AM

- Why_Yes_I_Do

- 06-06-2022, 11:08 AM

I clipped these tweets from an article published the the other day from KimDotCom's twatter feed. (I'm not a twitter user). Apparently he has an unusual process of using something called observed data and math. New-agey schtuff fo sho. Who knows, some day we might even use science.

Oh, and might ought to consider disarming the populace before hand. Juss say'n

Kim Dotcom Posts Ominous Thread About “Major Global Collapse That Is Coming”PSA Reminder: The mid-terms are coming

...

This may be the most important thread I ever make. Big picture stuff about the major global collapse that is coming. I will try to help you understand why the future is not what we’re hoping for. It’s worse than most can imagine. Our leaders know. But what are they planning?

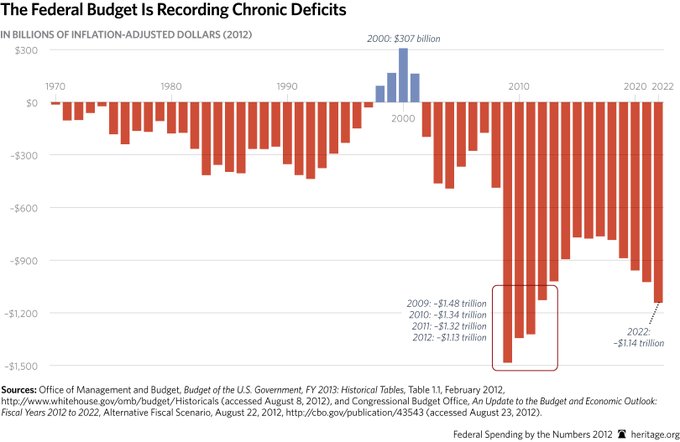

The United States did not have a surplus or a balanced budget since 2001. In the last 50 years the US only had 4 years of profit. In fact all the profit the US had would not be enough to pay for 6 months of the current yearly deficit. So how did the US pay for things?

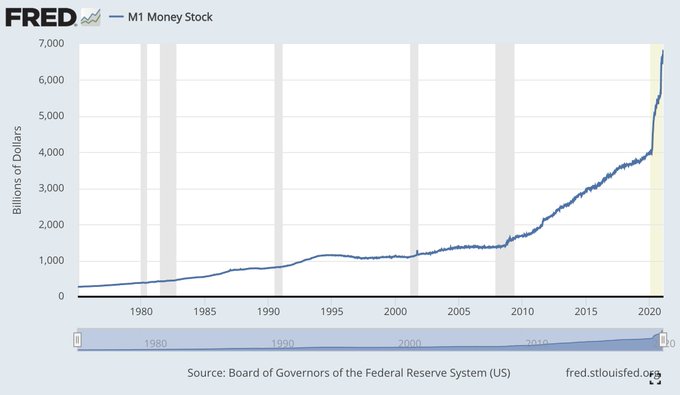

US spending and debt have spiraled out of control and the Govt can only raise the money it needs by printing it. That causes inflation. It’s like taxing you extra because you pay more for the things you need and all your assets decline in value. See the US money printing frenzy:

The reason why the US got away with it for so long is because USD is the worlds reserve currency. Nations everywhere hold USD as a secure asset. So when the US Govt prints trillions it’s robbing Americans and the entire world. The biggest theft in history.

60 Minutes video on Twitter (31 seconds)

The problem is that this has been going for decades and there’s now no way to fix it. The reality is that the US has been bankrupt for some time and what’s coming is a nightmare: Mass poverty and a new system of control. Let me explain why this isn’t just doom and gloom talk.

Total US debt is at $90 trillion. US unfunded liabilities are at $169 trillion. Combined that’s $778,000 per US citizen or $2,067,000 per US tax payer. Remember, the only way the US Government can operate now is by printing more money. Which means hyperinflation is inevitable.

The total value of ALL companies listed on the US stock market is $53 trillion. The real value is much lower because the US has been printing trillions to provide interest free loans to investment banks to pump up the stock market. It’s a scam. Most of the $53 trillion is air.

The value of all US assets combined, every piece of land, real estate, all savings, all companies, everything that all citizens, businesses, entities and the state own is worth $193 trillion. That number is also full of air just like the US stock market.

Let’s do the math:

- US total debt $90 trillion

- US unfunded liabilities $169 trillion

- Total $259 trillion

- Minus all US assets $193 trillion

- Balance – $66 trillion

That’s $66 trillion of debt and liabilities after every asset in the US has been sold off. Do you understand?

So even if the US could sell all assets at the current value, which is impossible, it would still be broke. The US is beyond bankrupt. This patient is already dead. This patient is now a zombie. You probably wonder why are things still going? Why didn’t everything collapse yet.

It’s all perception, denial and dependency. The perception is that the US has the largest economy and the strongest military in the world. But in reality the US is broke and can’t afford its army. The denial is that all nations depend on a strong USD or global markets collapse.

The reason why the US zombie keeps going is because the end of the US is the end of western prosperity and an admission that the current system failed as a model for the world. It doesn’t change the reality. The collapse is inevitable and coming. What are our leaders planning?

You may have heard about the ‘great reset’ or the ‘new world order’. Is it a controlled demolition of the global markets, economies and the world as we know it? A shift into a new dystopian future where the elites are the masters of the slaves without the cosmetics of democracy?

Without a controlled demolition the world will collapse for all, including the elites. The world has changed so much and nothing seems to make sense anymore, the blatant corruption is out in the open, the obvious propaganda media, the erosion of our rights. What’s the end game?

Oh, and might ought to consider disarming the populace before hand. Juss say'n

- eccieuser9500

- 06-06-2022, 11:12 AM

- Chung Tran

- 06-06-2022, 04:06 PM

That article is nonsense. He decides some figures are ''air'' while others are ''real''. Why did inflation just recently kickstart? The same voodoo math was present a year ago.. 3 years ago. Ten years ago.

He decided that assets don't equal liabilities plus equity.

He decided that assets don't equal liabilities plus equity.

- WTF

- 06-06-2022, 05:06 PM

Captain, Tiny is going to cry himself to sleep when he ever acknowledges that Starve the Beast , in fact did what I've been saying it was doing. That is , encouraging Americans to want more and more and pay less and less in taxes. A disaster.

Progressive have always wanted to spend...the reason I left any support for the Republican party was that they forgot about the deficits.

They are no different than Progressive fiscally and , and I do not agree with their stance on Social issues.

So I do not agree with either party in regards to fiscal policy. They're both full of shit.

I do agree with Progressive more than not on the social side.

I've argued that the only time Republicans are Republicans of old....is when there is a Democrat in the WH.

I will say that the Social spending side of the ledger has been paid for to date. There have been no borrowing on the SS and Medicare side of the ledger. For continually talk about the coming deficits to those programs in 2033 but I could expand that out by removing the 130k cap on SS/ Medicare cap.

You can not say that about the discretionary spending side of the aisle.

Progressive have always wanted to spend...the reason I left any support for the Republican party was that they forgot about the deficits.

They are no different than Progressive fiscally and , and I do not agree with their stance on Social issues.

So I do not agree with either party in regards to fiscal policy. They're both full of shit.

I do agree with Progressive more than not on the social side.

I've argued that the only time Republicans are Republicans of old....is when there is a Democrat in the WH.

I will say that the Social spending side of the ledger has been paid for to date. There have been no borrowing on the SS and Medicare side of the ledger. For continually talk about the coming deficits to those programs in 2033 but I could expand that out by removing the 130k cap on SS/ Medicare cap.

You can not say that about the discretionary spending side of the aisle.

- Tiny

- 06-07-2022, 12:45 PM

I’m really enjoying my martyrdom in solidarity. I’ve gotten some face time with a few of the Saints of Classical Liberalism. Saint Ludwig (von Mises) is a hoot after a couple of beers. That was a real surprise, I thought he was BORING.

The other day Saint Milton and Saint Friedrich were having a good laugh over an editorial Silly Paul Krugman published,

https://www.nytimes.com/2022/06/03/o...l-reserve.html

Silly Paul seems to think our 3.5% to 4% trimmed mean PCE inflation rate is fine and dandy, perfectly acceptable going forward. The “trimmed mean PCE inflation rate” conveniently kicks out components when their prices are changing rapidly. Are used car prices up 40%? Kick them out. Medical care services are up 10%? Kick those out too. Prest-O change-O, inflation’s only 4%!

Milton and Friedrich were getting a kick out of comparing this to a paper that Larry Summers et al published, which concluded that Powell and the Fed are now tasked with achieving the same amount of disinflation as achieved under Fed Chairman Paul Volcker in the early 1980’s.

https://www.bloomberg.com/news/artic...ers-group-says

The other day Saint Milton and Saint Friedrich were having a good laugh over an editorial Silly Paul Krugman published,

https://www.nytimes.com/2022/06/03/o...l-reserve.html

Silly Paul seems to think our 3.5% to 4% trimmed mean PCE inflation rate is fine and dandy, perfectly acceptable going forward. The “trimmed mean PCE inflation rate” conveniently kicks out components when their prices are changing rapidly. Are used car prices up 40%? Kick them out. Medical care services are up 10%? Kick those out too. Prest-O change-O, inflation’s only 4%!

Milton and Friedrich were getting a kick out of comparing this to a paper that Larry Summers et al published, which concluded that Powell and the Fed are now tasked with achieving the same amount of disinflation as achieved under Fed Chairman Paul Volcker in the early 1980’s.

https://www.bloomberg.com/news/artic...ers-group-says

- Tiny

- 06-07-2022, 12:47 PM

The Saints of Classical Liberalism are very disappointed in WTF. They sent their prophets, Lusty Lad and Captain Midnight, to eccie to spread the truth and the light. People though distort the words of the prophets. Take the example of the greatest prophet, Jesus. His word was used to promote peace and brotherly love, along with many good works, like water wells in Africa. But it was also used to justify the Crusades and the Inquisition.

Similarly WTF has taken the words of the prophet Captain Midnight and tried to use them for his own evil ends. I speak in particular of this,

My dear WTF, Saint Ronald gave me a personal message to deliver to you. You were wrong to view the effect on revenues of the Economic Recovery Tax Act of 1981, which cut tax rates by 28.5%, in the absence of the other Acts during his administration. For yes, as Saint Ronald’s humble servant David Stockman wrote, the American Congress was not willing to cut spending. And so in 1982 some of the tax cuts were undone. And in 1984 a bill was passed that closed tax loopholes. And in 1986, the top marginal rate was reduced to 28%, and tax write-offs, preferences and exceptions were eliminated.

Like you WTF, I lived in ignorance. Unlike you, I have never believed the chief end of man is to enrich government. And I have always preferred to leave more money in the hands of the people and businesses. However, like you, I thought that government revenues were maximized by increasing tax rates, up to maximum levels of around 28% for capital gains and 45% for ordinary income. And that tax increases in excess of those levels may cause revenues to fall.

However, thanks to the gifts of the Prophets, I am no longer sure of that. For Lusty Lad has written that tax revenue now, after the Ryan/McConnell/Trump tax cuts, is booming. And the corporate tax revenues are exceeding CBO pre-2017 (pre tax cuts) estimates:

https://www.eccie.net/showpost.php?p=1062853830

And Captain Midnight has bestowed us with the article from CNN showing that while Reagan and O’Neill and others were cutting the maximum rate from 70% to 28%, the tax revenues collected by the government edged up.

And then on June 5, shortly before my martyrdom, I read this NEWS (not editorial) article from the Wall Street Journal, highlighting that individual tax receipts, as a % of GDP will reach an all time high during this year, 2022. Yes, an all time high, despite the Ryan/McConnell/Trump tax cuts:

https://www.wsj.com/articles/individ...el-11654421400

I pray you will read and understand. For the Saints of Classical Liberalism have grown tired of your evil ways. And they have threatened to unleash an avenging angel, Little Murray Rothbard, upon you. He will come to earth and cut your balls off. So please head my words.

Similarly WTF has taken the words of the prophet Captain Midnight and tried to use them for his own evil ends. I speak in particular of this,

Likewise, I've enjoyed asking a couple of left-leaning members of my very large, extended family whether they are aware that Reagan actually raised taxes on the wealthy.And so when I confront WTF with the Cliff Notes version of the link that the Prophet provided us, what is WTF’s reply? When I point out that the end result of the tax rate cuts, the broadening of the base, and the elimination of tax shelters and loopholes during the 8 years of the Reagan administration was an increase in tax revenue as a % of GDP from 18.1%, under Carter, to 18.2%, what does he say? WTF says it’s horseshit.

Yes, I know. "Everyone" seems to think that tax cuts on the wealthy were a prominent feature of Reagan's agenda, in pursuit of a "trickle-down economics" agenda.

But what if I were to tell you that, contrary to popular belief, that's not remotely what happened/

If you doubt that, please have a look at this:

https://money.cnn.com/2010/09/08/new...n_years_taxes/

This article was something of an eye-opener for some who looked only at the change in the statutory top-bracket marginal tax rate without understanding how the pre-1986 tax code actually worked.

. Originally Posted by CaptainMidnight

My dear WTF, Saint Ronald gave me a personal message to deliver to you. You were wrong to view the effect on revenues of the Economic Recovery Tax Act of 1981, which cut tax rates by 28.5%, in the absence of the other Acts during his administration. For yes, as Saint Ronald’s humble servant David Stockman wrote, the American Congress was not willing to cut spending. And so in 1982 some of the tax cuts were undone. And in 1984 a bill was passed that closed tax loopholes. And in 1986, the top marginal rate was reduced to 28%, and tax write-offs, preferences and exceptions were eliminated.

Like you WTF, I lived in ignorance. Unlike you, I have never believed the chief end of man is to enrich government. And I have always preferred to leave more money in the hands of the people and businesses. However, like you, I thought that government revenues were maximized by increasing tax rates, up to maximum levels of around 28% for capital gains and 45% for ordinary income. And that tax increases in excess of those levels may cause revenues to fall.

However, thanks to the gifts of the Prophets, I am no longer sure of that. For Lusty Lad has written that tax revenue now, after the Ryan/McConnell/Trump tax cuts, is booming. And the corporate tax revenues are exceeding CBO pre-2017 (pre tax cuts) estimates:

https://www.eccie.net/showpost.php?p=1062853830

And Captain Midnight has bestowed us with the article from CNN showing that while Reagan and O’Neill and others were cutting the maximum rate from 70% to 28%, the tax revenues collected by the government edged up.

And then on June 5, shortly before my martyrdom, I read this NEWS (not editorial) article from the Wall Street Journal, highlighting that individual tax receipts, as a % of GDP will reach an all time high during this year, 2022. Yes, an all time high, despite the Ryan/McConnell/Trump tax cuts:

https://www.wsj.com/articles/individ...el-11654421400

I pray you will read and understand. For the Saints of Classical Liberalism have grown tired of your evil ways. And they have threatened to unleash an avenging angel, Little Murray Rothbard, upon you. He will come to earth and cut your balls off. So please head my words.

- dilbert firestorm

- 06-07-2022, 01:39 PM

Tiny... Think WTF is PT Barnum? "sucker born every minute"

- Tiny

- 06-07-2022, 02:03 PM

- Why_Yes_I_Do

- 06-07-2022, 02:17 PM

- lustylad

- 06-07-2022, 02:56 PM

Empirical evidence shows that Starve the Beast may be counterproductive... Originally Posted by WTF

So, after initially seeing an effort to "starve the beast," we've had massive and seemingly never-ending efforts to "let the beast have a feast." Originally Posted by CaptainMidnightIn what fucking parallel universe is anyone nowadays seriously talking about STARVING THE BEAST?

Oh wait, I should've guessed - it's our resident hyper-partisan hack faux fraudulent economically-illiterate, simple-minded, arrogant, ignorant and stubbornly brainwashed know-it-all Professor Poofter!

(Yes, I know "ignorant know-it-all" may sound like an oxymoron, but it fits WTF perfectly! He is obliviously ignorant of how little he knows! Like most people who act like know-it-alls, he is more accurately described as a "know-nothing".)

Ever notice how Professor Poofter never furnishes up-to-date data or empirical evidence or numbers to support his meager arguments? It's because his aptitude at math is even skimpier than his verbal and communication skills!

I don't start very many threads lately. But my last 2 threads have been eye-openers for anyone stupid and gullible enough to believe the federal government is being starved for funds!

As I pointed out, corporate tax revenues are projected to hit $454 billion in the current fiscal year (2022). That's 22% higher than our record-high FY 2021 receipts, and 53% ahead of FY 2017 - the last year before Trump signed the TCJA into law, lowering the corporate rate. Yeah you heard me right - far from "starving the beast", Trump's tax cut on the corporate side is unleashing a 53% surge in annual federal revenues!

https://www.eccie.net/showthread.php?t=2844405

Then there is my other thread where I noted how overall federal tax revenues (including individual and payroll) are up by a whopping 39% YTD! Not only is the beast not being starved, but precisely the opposite is occurring! The federal behemoth is currently fattening and gorging itself at a rate 3-1/2 times faster than the overall US economy!

Look at it this way - for every $100 that your income is rising, Uncle Sam is raking in $348 more!

Only a malicious moron like WTF would muck up a brilliant thread like this with the completely false narrative that those of us who are seeking to save the country from our unfolding progressive disaster are somehow trying to "starve the beast"!

So.... to get this thread back on topic, if Uncle Sam's income is surging by 39%, what about the rest of the country?https://www.eccie.net/showthread.php?t=2849272

Is our national income growing commensurately? I mean, I wouldn't object so much to Uncle Sam getting the same (proportionate) slice of the pie, as long as everyone else is getting theirs too.

The relevant period we are looking at is the first 7 months of the current fiscal year. That is, from October 1, 2021 to April 30, 2022.

We can get a rough idea of the answer if we look at how much US nominal GDP grew in the first 6 months of FY 2022, since that data is available. For those of you (like WTF) who either never studied economics or flunked out miserably, nominal GDP means current-dollar or non-inflation-adjusted Gross Domestic Product. We need to look at those numbers (rather than real or inflation-adjusted GDP) because taxes are reported in nominal terms, and we want to make an apples-to-apples comparison.

A wee bit of research on my part reveals that US nominal GDP totaled $12.095 trillion in the first two quarters of this fiscal year, up from $10.88 trillion in the corresponding period of FY 2021. That's an increase of 11.2%. Here's a link to the St. Louis Federal Reserve data series for anyone who would care to check my calculations. Please note their figures are quarterly annualized.

https://fred.stlouisfed.org/series/GDP

So what's my point? Well, during a period when our national income in nominal terms expanded at an 11.2% rate, the federal government saw its own income explode by 39%. That's roughly 3-1/2 times as fast as the overall economy!!

Bottom line - The DC swamp is sucking in a hugely disproportionate share of the fruits of our labor. For every marginal dollar of income we the people are generating, the feds are expanding their slice of the pie over three times faster! This is just another reason why so many Americans feel they are on a treadmill going backwards, not forward. The only sure way to get rich is to move to the DC swamp! Originally Posted by lustylad

- Tiny

- 06-07-2022, 03:02 PM

I will agree with you in one respect, but then would like to look at the other side of the coin in an effort to fully view the crux of the predicament that we as a nation are in.WTF, This is another message from one of the prophets, written for you. It's spot on. The solution lies through controlling spending, not raising taxes on the top 1% to the levels favored by Progressives.

First, there's little disagreement that what some referred to decades ago as an effort to "starve the beast" has not worked well.

Looks like the constituencies advocating for greatly expanded government largesse are more powerful than those calling for tax cuts. Just look at the extent to which spending has continually been ratcheted up over the last half-century, but especially during the last two decades.

Nothing gets cut. Everything gets ratified, expanded, or accompanied by expensive new programs. Among other things, these include transfer programs, vote-buying social welfare initiatives, unnecessary "stimulus" and "rescue" programs, phony "infrastructure" packages, etc.

Of course, some countercyclical spending was needed to get us through the pandemic era, but the total was greatly in excess of the aggregate amount of lost personal income and the economy's estimated output gap.

Military outlays have increased significantly as well, though that factor pales in comparison with expansions of social spending over the last few decades.

So, after initially seeing an effort to "starve the beast," we've had massive and seemingly never-ending efforts to "let the beast have a feast."

Progressives apparently feel that if you just get all this stuff shoved through, no one will ever do anything to oppose it, lest they get landslided out of office in the next presidential or midterm election cycle.

Then the argument will always be that we need to increase taxes, although only on the top one percent of the income and net worth distribution.

As we've discussed in numerous posts, that means that we will be running ginormous fiscal deficits forever. (Or at least until something busts!)

. Originally Posted by CaptainMidnight

Gary Johnson, who I believe you agree was one of the wisest of the sages (or at least you voted for him) understood this. And that's why he used the veto 739 times when he was governor, mostly to control spending. That doesn't count his many additional line item vetoes in state budgets.

- Tiny

- 06-07-2022, 03:05 PM

- lustylad

- 06-07-2022, 03:18 PM

From yesterday's Wall Street Journal:

Cancel Milton Friedman, and Inflation Is What You Get

The word ‘money’ doesn’t even appear in President Biden’s plan to whip inflation.

June 5, 2022 11:45 am ET

The lead paragraph of President Biden’s op-ed “My Plan for Fighting Inflation” (May 31) asserts that the global economy faces an inflation problem exacerbated by Vladimir Putin’s war in Ukraine, high oil prices and supply-chain problems. This line of argument shows why the president’s team and the experts at the Federal Reserve were unable to anticipate the inflation conundrum that their economic missteps have forced us into. It also shows why the president’s plan will likely fail to allow us to exit inflation with a smooth landing.

We don’t have a global inflation problem. Inflations are always and everywhere a monetary phenomenon spawned by the creation of excess money by local central banks. China, Japan and Switzerland also face elevated oil prices, supply-chain problems and fallout from the war in Ukraine, but their annual inflation rates are 2.1%, 2.5% and 2.5%, respectively. They have avoided the ravages of inflation because their central banks haven’t produced excessive quantities of money.

Adherence to the tenets of monetarism is nowhere to be found in the Biden White House or the Fed. Chairman Jerome Powell has stressed that we had to “unlearn” monetarism. It looks like Mr. Biden was an attentive student. The word “money” doesn’t even appear in his plan to whip inflation. As he said in 2020, “Milton Friedman isn’t running the show anymore.” As long as Friedman and monetarism remain canceled, the White House and the Fed will be grasping for straws.

Prof. Steve Hanke and John Greenwood

Johns Hopkins University

Cancel Milton Friedman, and Inflation Is What You Get

The word ‘money’ doesn’t even appear in President Biden’s plan to whip inflation.

June 5, 2022 11:45 am ET

The lead paragraph of President Biden’s op-ed “My Plan for Fighting Inflation” (May 31) asserts that the global economy faces an inflation problem exacerbated by Vladimir Putin’s war in Ukraine, high oil prices and supply-chain problems. This line of argument shows why the president’s team and the experts at the Federal Reserve were unable to anticipate the inflation conundrum that their economic missteps have forced us into. It also shows why the president’s plan will likely fail to allow us to exit inflation with a smooth landing.

We don’t have a global inflation problem. Inflations are always and everywhere a monetary phenomenon spawned by the creation of excess money by local central banks. China, Japan and Switzerland also face elevated oil prices, supply-chain problems and fallout from the war in Ukraine, but their annual inflation rates are 2.1%, 2.5% and 2.5%, respectively. They have avoided the ravages of inflation because their central banks haven’t produced excessive quantities of money.

Adherence to the tenets of monetarism is nowhere to be found in the Biden White House or the Fed. Chairman Jerome Powell has stressed that we had to “unlearn” monetarism. It looks like Mr. Biden was an attentive student. The word “money” doesn’t even appear in his plan to whip inflation. As he said in 2020, “Milton Friedman isn’t running the show anymore.” As long as Friedman and monetarism remain canceled, the White House and the Fed will be grasping for straws.

Prof. Steve Hanke and John Greenwood

Johns Hopkins University

- Tiny

- 06-07-2022, 03:36 PM

We don’t have a global inflation problem. Inflations are always and everywhere a monetary phenomenon spawned by the creation of excess money by local central banks. China, Japan and Switzerland also face elevated oil prices, supply-chain problems and fallout from the war in Ukraine, but their annual inflation rates are 2.1%, 2.5% and 2.5%, respectively. They have avoided the ravages of inflation because their central banks haven’t produced excessive quantities of money. Originally Posted by lustyladThat's a good reply to those who say the Fed and our politicians don't deserve any blame for the level of inflation. "It's all the supply chain." Or Russia and Ukraine. Right.

I haven't looked at the numbers, but I'd bet our fiscal stimulus as a % of GDP during COVID, including Biden's American Rescue Plan that needlessly fanned the flames of inflation, was higher than those countries too.

The EU and the UK are the only other major economies with inflation as high as the USA's, and I believe their monetary policies have been about as loose as ours.