Obama says it is critical that the rich pay higher taxes, and he has long argued that it was the Bush tax cuts which put us in this mess, since the rich aren't paying their "fair share." The Republicans say it is critical that we avoid raising tax rates on anyone, since higher tax rates would jeopardize the health of the economy. As the numbers show, higher tax rates on the rich would make only a small difference to the projected deficit, since the health of the economy and the level of federal spending are by far the major determinants of the deficit.

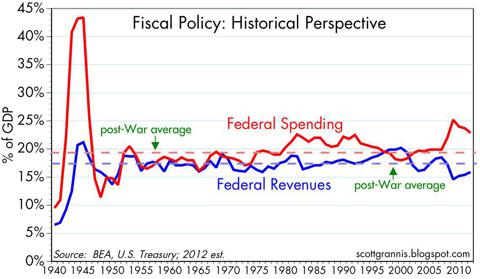

This first chart puts the federal budget in the proper long-term perspective, measuring spending and revenues as a percentage of GDP. Spending is still well above its post-War average (22.9% vs. 19.3%), whereas revenues are only slightly below their post-War average (15.9% vs. 17.3%). If you assume that post-War averages are the norm, then 72% of the current budget deficit of 7% of GDP is due to excess spending, and 28% is due to a revenue shortfall. It's important to note here that federal revenues exceeded their post-War average from 2005 to 2008 despite the Bush tax cuts. Those same tax rates are delivering disappointing tax revenues today because of a shortfall of jobs and the fact that our economy is about 10-12% below its potential output. It's the shrunken tax base, not lower tax rates, which is responsible for today's revenue shortfall. A healthier economy and faster jobs growth would do much more to close the deficit than any amount of higher tax rates on the rich.

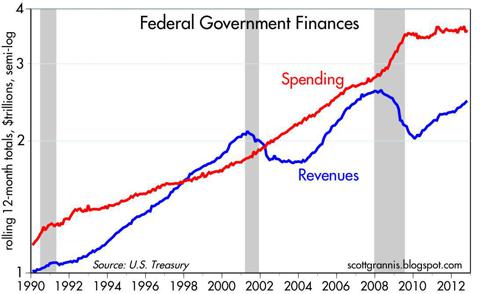

The chart above plots the running 12-month total of nominal federal spending and revenues. Two rather surprising revelations are apparent. First, after surging in 2008 and 2009, federal spending growth has slowed to a crawl, thanks mainly to Congressional gridlock and the unwinding of automatic stabilizers (e.g., fewer people collecting unemployment insurance). Second, revenues have surged by $446 billion since hitting a low in early 2010, without any increase in tax rates and despite a two-year payroll tax holiday, mainly because an expanding economy, rising corporate profits, and the addition of 5 million new jobs have expanded the tax base. Even if the economy were to continue growing at a measly 2% rate, there is every reason to think that revenues would continue to rise without the need for higher tax rates. Raising tax rates, however, might weaken the economy further, and that would make it much more difficult to generate higher tax revenues.

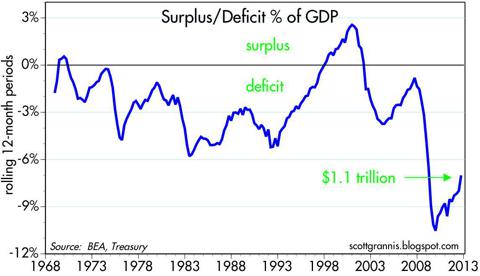

The chart above shows the impressive reduction in the federal deficit as a percent of GDP that has occurred over the past three years—from a high of 10.5% in late 2009 to the current 7%. If nothing changes and current trends were to continue (spending growth of 3% per year, revenue growth of 7% per year, and nominal GDP growth of 4% per year), the deficit would decline to approximately 6% of GDP by the end of next year, and return to its long-term historic average of 2% of GDP in seven years. Nobody's taxes need to be raised, and nobody's spending needs to be cut—the U.S. economy is already on a glide path to the restoration of fiscal sanity. Washington: are you listening?

But if anything is likely to change in a big way in coming years, it is increased entitlement spending, particularly under ObamaCare and Social Security. This is what should be getting the priority these days, not tax rates.

I happened on a Bloomberg News article this morning (which for some reason I am unable to find on the web) that reinforces my point that the shortfall in revenue today is not due to tax rates that are too low, but rather due to a weak economy:

... boosting taxes for the wealthiest 2 percent would bring in $58.1 billion in fiscal year 2013, according to Bloomberg calculations based on data from the [left-leaning] Tax Policy Center. The CBO estimates the government's finances will show a shortfall of $1.04 trillion, assuming almost all the tax increases and automatic spending cuts that are slated to take effect next year are totally averted.

"It's not very much, but it is a step in the right direction," Roberton Williams, a senior fellow at the nonpartisan Tax Policy Center in Washington, said in a telephone interview. "In order to close half the budget deficit by raising taxes on the rich, you would have to raise their tax rate up to about 90 percent. That's not going to happen."

According to some estimates I've seen, if Obama gets his request for higher income, dividend, capital gains and estate tax rates rise for those making more than $250K per year, that could raise up to $120 billion to federal revenues next year, assuming no adverse consequences for economic growth. That's not an assumption I'm comfortable making, but nevertheless the revenue gains that might result from boosting tax rates for the rich are still a relatively small fraction of the total projected deficit.

Greg Mankiw uses data from the Tax Policy Center to make the point that putting a cap on total deductions could raise significant revenue from the rich without increasing their marginal tax rates, and that is important since it avoids creating a disincentive to additional work and investment:

According to the Tax Policy Center, if we cap itemized deductions at $50,000 and keep tax rates as they are today, we would raise $749 billion in tax revenue over ten years. Moreover, according to the TPC's distribution table, 96.2 percent of the extra revenue would come from the top quintile, with 79.9 percent from the top one percent.

Given today's political realities, the best outcome of the "fiscal cliff" negotiations, from my perspective, would be an agreement to meaningfully reduce future spending on entitlements, extend the current tax structure for at least another year or two, and put a cap on total deductions. This would reinforce the fiscal sanity glide path (i.e., slow growth in spending coupled with continued expansion of the tax base), and give politicians and markets plenty of time to notice that the U.S. federal budget outlook is not nearly as bad as most seem to believe.

If the "fiscal cliff" negotiations end up being driven by political considerations rather than economic realities, higher tax rates on the rich would only increase the odds that the economy is likely to continue growing at a sub-par pace (i.e., growth that is insufficient to return the economy to its full potential) for the foreseeable future. That would be a very unfortunate conclusion to such an important policy debate.

Source: Seeking Alpha

---

Fiscal-Cliff Fallout: How The Alternative Minimum Tax (AMT) Would Hit Taxpayers

Jeff Werling Inforum/University Of Maryland "FISCAL SHOCK" America’s Economic Crisis: The Impact Of The Pending Fiscal Crisis On Jobs And Economic Growth Analysis Using The LIFT Model

Prepare For A 15% Food Price Surge, Rabobank Warns

$648 Trillion Derivatives Market Faces New Collateral Concentration Risks

The U.S. Fiscal Gap Is Now $222 Trillion. Last Year, It Was $211 Trillion

Financial Services Subcommittee on Domestic Monetary Policy "The Price of Money: Consequences of the Federal Reserve's Zero Interest Rate Policy" 9/21/2012