PICKET: New book shows U.S. top earners pay larger share of taxes than any other industrialized nation

← return to Water Cooler

<LI class=addthis_button_comments>Comments (267)<LI class=addthis_button_txtsize>S ize: + / -<LI class=addthis_button_printer>Print

Share on facebookShare on twitterShare on google_plusone_shareShare on redditShare on linkedinShare on stumbleuponShare on emailMore Sharing Services

By Kerry Picket - The Washington Times

Recent Entries

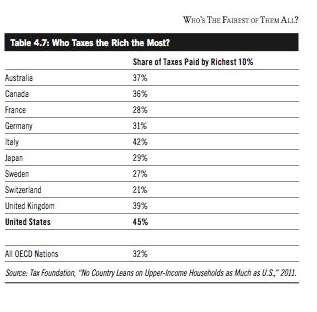

The Wall Street Journal's Stephen Moore has just come out with a new book titled Who's the Fairest of Them All?: The Truth about Opportunity, Taxes, and Wealth in America and he reveals some interesting information about how much the top ten percent of income earners in the United States pay in federal income taxes as opposed to any other industrialized nation in the world.

According to Moore, these earners pay almost half (45 percent) of the country's total taxes. This conclusion flies in the face of the liberal concept that top earners in the U.S. are not paying their "fair share" in taxes. Moore explains:

The Heritage Foundation has been arguing these facts for years. Consider what happened each time the U.S. reduced the tax rate significantly:

Read more: PICKET: New book shows U.S. top earners pay larger share of taxes than any other industrialized nation - Washington Times http://www.washingtontimes.com/blog/...#ixzz28u7q3dPY

Follow us: @washtimes on Twitter

← return to Water Cooler

<LI class=addthis_button_comments>Comments (267)<LI class=addthis_button_txtsize>S ize: + / -<LI class=addthis_button_printer>Print

Share on facebookShare on twitterShare on google_plusone_shareShare on redditShare on linkedinShare on stumbleuponShare on emailMore Sharing Services

By Kerry Picket - The Washington Times

October 9, 2012, 12:32PM

Recent Entries

- PICKET: Poll - Romney closing gap in CT

- PICKET: Banking crooks in Obama Big Bird ad all indicted by Bush DOJ

- PICKET: New book shows U.S. top earners pay larger share of taxes than any other industrialized nation

- PICKET: Rep. Matheson remains silent on Eric Holder and down in the polls

- PICKET: Coulter shreds 'southern strategy' myth as GOP successfully runs more blacks in conservative districts

The Wall Street Journal's Stephen Moore has just come out with a new book titled Who's the Fairest of Them All?: The Truth about Opportunity, Taxes, and Wealth in America and he reveals some interesting information about how much the top ten percent of income earners in the United States pay in federal income taxes as opposed to any other industrialized nation in the world.

According to Moore, these earners pay almost half (45 percent) of the country's total taxes. This conclusion flies in the face of the liberal concept that top earners in the U.S. are not paying their "fair share" in taxes. Moore explains:

"The United States is actually more dependent on rich people to pay taxes than even many of the more socialized economies of Europe. According to the Tax Foundation, the United States gets 45 percent of its total taxes from the top 10 percent of tax filers, whereas the international average in industrialized nations is 32 percent. America’s rich carry a larger share of the tax burden than do the rich in Belgium (25 percent), Germany (31 percent), France (28 percent), and even Sweden (27 percent)."Moore also delves into what the "47 percent" of America actually pays and receives from the federal government and that the perception that the middle class is shrinking is a myth. In fact, the actual trend has been an upward mobility and a better standard of living for the middle class and lower income earners in the last 25 years.

The Heritage Foundation has been arguing these facts for years. Consider what happened each time the U.S. reduced the tax rate significantly:

1920s: The top tax rate fell from 73 percent to 25 percent, yet the rich (in those days, those earning $50,000 and up) went from paying 44.2 percent of the tax burden in 1921 to paying more than 78 percent in 1928.Additionally, more tax revenue went back to the federal government each time the taxes were lowered. So does it really make sense to strip the upper income earners of their keep? Liberals have yet to answer how that ever improves the lives' of the middle class or lower income earners in the long run.

1960s: President John F. Kennedy slashed the top tax rate from 91 percent to 70 percent. In the ensuing three years, those making more than $50,000 annually saw their tax payments rise by 57 percent, and their share of the tax burden climbed from 11.6 percent to 15.1 percent.

1980s: The Reagan years saw the top rate fall from 70 percent in 1980 to 28 percent in 1988. What happened to the rich? The top 1 percent went from shouldering 17.6 percent of the income tax burden in 1981 to paying 27.5 percent of the total in 1988. The top 10 percent saw their share of the burden climb from 48 percent in 1981 to over 57 percent in 1988.

Read more: PICKET: New book shows U.S. top earners pay larger share of taxes than any other industrialized nation - Washington Times http://www.washingtontimes.com/blog/...#ixzz28u7q3dPY

Follow us: @washtimes on Twitter