- WTF

- 03-13-2020, 10:53 AM

- Submodo

- 03-13-2020, 12:39 PM

Shhh... not too loud, its not Socialism when Republicans do it.

- oeb11

- 03-13-2020, 01:53 PM

Fascist DPST's would cheerfully destroy America to remove Trump.

The propaganda mill is still spinning overtime and out of control for the DPST"s

They are "dancing with delight" over the financial issues.

Thinking voters will swing Socialist with the biden impending nomination and economic issues .

Guess what - Americans think for themselves - and will make their own decisions - and the LSM can try to dictate the narrative all they want - but there is still a modicum of press and media freedom to report Facts rather than DPST narrative "Truth"!

The propaganda mill is still spinning overtime and out of control for the DPST"s

They are "dancing with delight" over the financial issues.

Thinking voters will swing Socialist with the biden impending nomination and economic issues .

Guess what - Americans think for themselves - and will make their own decisions - and the LSM can try to dictate the narrative all they want - but there is still a modicum of press and media freedom to report Facts rather than DPST narrative "Truth"!

- WTF

- 03-13-2020, 08:20 PM

Sounds like someone is already making excuses about the bailout...

- eccieuser9500

- 03-13-2020, 08:56 PM

Sounds like someone is already making excuses about the bailout... Originally Posted by WTFThat sound has been echoing since I heard Reagan bailout the banks and fire the FAA staff. I though, at the time, "the bank doesn't have money?"

"Reagan-era legislative changes essentially ended New Deal restrictions on mortgage lending — restrictions that, in particular, limited the ability of families to buy homes without putting a significant amount of money down.

These restrictions were put in place in the 1930s by political leaders who had just experienced a terrible financial crisis, and were trying to prevent another. But by 1980 the memory of the Depression had faded. Government, declared Reagan, is the problem, not the solution; the magic of the marketplace must be set free. And so the precautionary rules were scrapped.

Together with looser lending standards for other kinds of consumer credit, this led to a radical change in American behavior.”

Paul Krugman

- gnadfly

- 03-13-2020, 09:03 PM

DemPanic extortion money. That's what I call it. The Dims and the Media are hoping for Trumps failure. Still 41 deaths.

- The_Waco_Kid

- 03-13-2020, 10:29 PM

That sound has been echoing since I heard Reagan bailout the banks and fire the FAA staff. I though, at the time, "the bank doesn't have money?"

"Reagan-era legislative changes essentially ended New Deal restrictions on mortgage lending — restrictions that, in particular, limited the ability of families to buy homes without putting a significant amount of money down.Paul Krugman

These restrictions were put in place in the 1930s by political leaders who had just experienced a terrible financial crisis, and were trying to prevent another. But by 1980 the memory of the Depression had faded. Government, declared Reagan, is the problem, not the solution; the magic of the marketplace must be set free. And so the precautionary rules were scrapped.

Together with looser lending standards for other kinds of consumer credit, this led to a radical change in American behavior.”

Originally Posted by eccieuser9500

Krugman is an idiot. and the S&L bailout was about Savings and loan banks, not commercial banks.

and you'd be better off focusing on who was president when HUD pressured Fannie Mae and Freddie Mac (who thinks up these stupid names??) to expand mortgages to unqualified minority buyers ..

this guy

stop blaming Ronnie a reformed REPUBLICAN for what a die hard DEMOCRAT did.

https://www.nytimes.com/1999/09/30/b...e-lending.html

Fannie Mae Eases Credit To Aid Mortgage Lending

By Steven A. Holmes

- Sept. 30, 1999

The action, which will begin as a pilot program involving 24 banks in 15 markets -- including the New York metropolitan region -- will encourage those banks to extend home mortgages to individuals whose credit is generally not good enough to qualify for conventional loans. Fannie Mae officials say they hope to make it a nationwide program by next spring.

Fannie Mae, the nation's biggest underwriter of home mortgages, has been under increasing pressure from the Clinton Administration to expand mortgage loans among low and moderate income people and felt pressure from stock holders to maintain its phenomenal growth in profits.

In addition, banks, thrift institutions and mortgage companies have been pressing Fannie Mae to help them make more loans to so-called subprime borrowers. These borrowers whose incomes, credit ratings and savings are not good enough to qualify for conventional loans, can only get loans from finance companies that charge much higher interest rates -- anywhere from three to four percentage points higher than conventional loans.

''Fannie Mae has expanded home ownership for millions of families in the 1990's by reducing down payment requirements,'' said Franklin D. Raines, Fannie Mae's chairman and chief executive officer. ''Yet there remain too many borrowers whose credit is just a notch below what our underwriting has required who have been relegated to paying significantly higher mortgage rates in the so-called subprime market.''

Demographic information on these borrowers is sketchy. But at least one study indicates that 18 percent of the loans in the subprime market went to black borrowers, compared to 5 per cent of loans in the conventional loan market.

In moving, even tentatively, into this new area of lending, Fannie Mae is taking on significantly more risk, which may not pose any difficulties during flush economic times. But the government-subsidized corporation may run into trouble in an economic downturn, prompting a government rescue similar to that of the savings and loan industry in the 1980's.

''From the perspective of many people, including me, this is another thrift industry growing up around us,'' said Peter Wallison a resident fellow at the American Enterprise Institute. ''If they fail, the government will have to step up and bail them out the way it stepped up and bailed out the thrift industry.''

Under Fannie Mae's pilot program, consumers who qualify can secure a mortgage with an interest rate one percentage point above that of a conventional, 30-year fixed rate mortgage of less than $240,000 -- a rate that currently averages about 7.76 per cent. If the borrower makes his or her monthly payments on time for two years, the one percentage point premium is dropped.

Fannie Mae, the nation's biggest underwriter of home mortgages, does not lend money directly to consumers. Instead, it purchases loans that banks make on what is called the secondary market. By expanding the type of loans that it will buy, Fannie Mae is hoping to spur banks to make more loans to people with less-than-stellar credit ratings.

Fannie Mae officials stress that the new mortgages will be extended to all potential borrowers who can qualify for a mortgage. But they add that the move is intended in part to increase the number of minority and low income home owners who tend to have worse credit ratings than non-Hispanic whites.

Home ownership has, in fact, exploded among minorities during the economic boom of the 1990's. The number of mortgages extended to Hispanic applicants jumped by 87.2 per cent from 1993 to 1998, according to Harvard University's Joint Center for Housing Studies. During that same period the number of African Americans who got mortgages to buy a home increased by 71.9 per cent and the number of Asian Americans by 46.3 per cent.

In contrast, the number of non-Hispanic whites who received loans for homes increased by 31.2 per cent.

Despite these gains, home ownership rates for minorities continue to lag behind non-Hispanic whites, in part because blacks and Hispanics in particular tend to have on average worse credit ratings.

In July, the Department of Housing and Urban Development proposed that by the year 2001, 50 percent of Fannie Mae's and Freddie Mac's portfolio be made up of loans to low and moderate-income borrowers. Last year, 44 percent of the loans Fannie Mae purchased were from these groups.

The change in policy also comes at the same time that HUD is investigating allegations of racial discrimination in the automated underwriting systems used by Fannie Mae and Freddie Mac to determine the credit-worthiness of credit applicants.

- eccieuser9500

- 03-14-2020, 12:08 AM

Krugman is an idiot. and the S&L bailout was about Savings and loan banks, not commercial banks.You'd be better served thinking back to how those families became "unqualified minority buyers".

and you'd be better off focusing on who was president when HUD pressured Fannie Mae and Freddie Mac (who thinks up these stupid names??) to expand mortgages to unqualified minority buyers .. Originally Posted by The_Waco_Kid

- The_Waco_Kid

- 03-14-2020, 12:27 AM

uh .. they were born that way? deformed? impoverished by evil whitey?

BAHHAAAAAA

you pick the stupidest shit to make the most useless points about nothing.

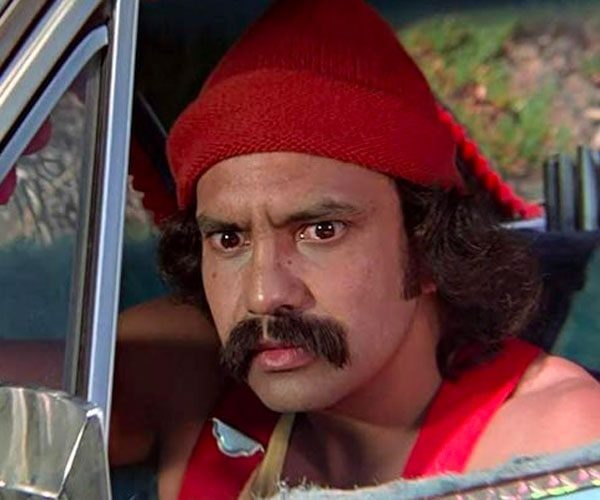

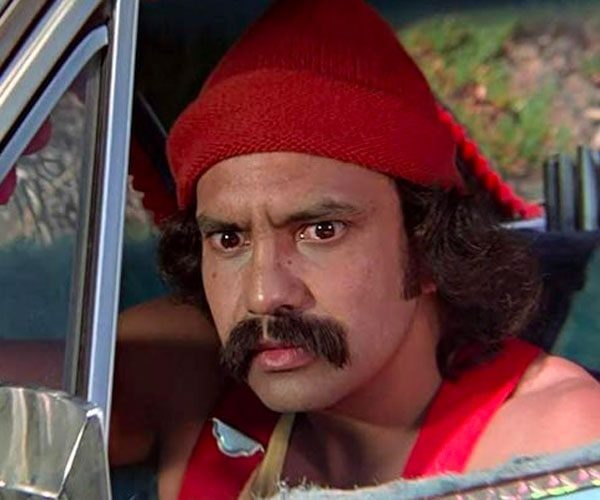

given all those photos of Cantinflas you like to post .. i don't think you are black. you are Hispanic and you grew up in the black ghetto. you are really ...

BAHHAHHAAAAAAAA

up in smoke homey!

BAHHAAAAAA

you pick the stupidest shit to make the most useless points about nothing.

given all those photos of Cantinflas you like to post .. i don't think you are black. you are Hispanic and you grew up in the black ghetto. you are really ...

BAHHAHHAAAAAAAA

up in smoke homey!

- eccieuser9500

- 03-14-2020, 12:45 AM

you pick the stupidest shit to make the most useless points about nothing.You're almost right. Half right. Which means your half wrong. And mostly wrong. Read my reviews. The clues are all in there.

given all those photos of Cantinflas you like to post .. i don't think you are black. you are Hispanic and you grew up in the black ghetto.

Originally Posted by The_Waco_Kid

But what does it matter? As long as you know I was raised right. I don't hate you because you're racist. I hate you more because your a conservative racist.

Notice the avatar of the YouTube channel on top of the first fram of the video. How avant-garde. Wouldn't you say?

I have the key to the universe.

- Jaxson66

- 03-17-2020, 07:55 AM

Trump administration seeks roughly $850 billion in emergency stimulus to confront coronavirus economic fallout

Treasury Secretary Steven Mnuchin will present details to Senate Republicans later Tuesday. The package would be mostly devoted to flooding the economy with cash, through a payroll tax cut or other mechanism, two of the officials said, with some $50 billion directed specifically to helping the airline industry.

https://www.washingtonpost.com/us-po...mulus-package/

Let the bailouts begin

Next up on the pandemic policy agenda: a rescue plan for the airlines and other industries hit hard by the global coronavirus pandemic.

This week you can expect to hear warnings from business groups about the jobs that will be lost, the bankruptcies that will be triggered, the financial panic that will ensue and the recession that will be prolonged if the government fails to act quickly and aggressively.

And there will be the predictable rants about putting taxpayers on the hook for “bailing out” undeserving shareholders, banks and hedge fund managers even as waiters, taxi drivers and maids are left to fend for themselves.

https://www.washingtonpost.com/busin...my-pearlstein/

Those shareholders of airlines bought their ticket, I say let them crash!

Treasury Secretary Steven Mnuchin will present details to Senate Republicans later Tuesday. The package would be mostly devoted to flooding the economy with cash, through a payroll tax cut or other mechanism, two of the officials said, with some $50 billion directed specifically to helping the airline industry.

https://www.washingtonpost.com/us-po...mulus-package/

Let the bailouts begin

Next up on the pandemic policy agenda: a rescue plan for the airlines and other industries hit hard by the global coronavirus pandemic.

This week you can expect to hear warnings from business groups about the jobs that will be lost, the bankruptcies that will be triggered, the financial panic that will ensue and the recession that will be prolonged if the government fails to act quickly and aggressively.

And there will be the predictable rants about putting taxpayers on the hook for “bailing out” undeserving shareholders, banks and hedge fund managers even as waiters, taxi drivers and maids are left to fend for themselves.

https://www.washingtonpost.com/busin...my-pearlstein/

Those shareholders of airlines bought their ticket, I say let them crash!

- Tsmokies

- 03-17-2020, 12:11 PM

Bankrupt in chief can shake their hands and tell them how to walk away and not have to pay shit to the working class. Tax cut in chief gave them a corporate bailout with his massive tax cut so they would support him and they could keep fucking the working people. Can Putin make America look more stupid?

- adav8s28

- 03-18-2020, 01:38 AM

- Unique_Carpenter

- 03-18-2020, 04:46 AM

Let's call it what it is.

The toilet paper supply industry economic support act.

Seriously though, most of the economic support proposals are inflation encouraging activity. Is everyone's mortgage locked in?

The toilet paper supply industry economic support act.

Seriously though, most of the economic support proposals are inflation encouraging activity. Is everyone's mortgage locked in?

- farmstud60

- 03-18-2020, 09:23 AM

Let's call it what it is.

The toilet paper supply industry economic support act.

Seriously though, most of the economic support proposals are inflation encouraging activity. Is everyone's mortgage locked in? Originally Posted by Unique_Carpenter

Total idiotic comment. This is a government shutdown of roughly 50% of the economy via a light switch. The cost of the rescue money is less than the amount of revenue the Federal government will not collect because of less economic activity. There is nothing remotely inflationary as the negative aspects are greater than the rescue amount. Will be lucky if this even stops it from turning into a deflationary depression.