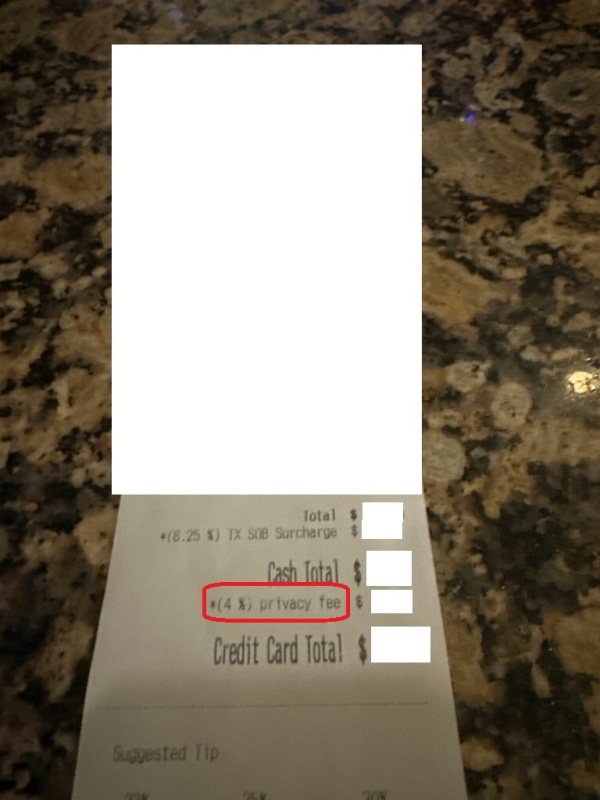

At bottom it looks pretty normal at first:

Total, the sales tax, then cash total, and then ....

Total _________ +

8.25% Tax _________ =

Cash Total _________ +

4% Privacy Fee _____ =

Credit Card Total _____

The Fuck?

It's also illegal for any business to charge any fees that are not clearly posted on signs or menus or inform the customer ahead of time before a service or product is provided. Originally Posted by CG2014

This club is also charging $5 when you ask to exchange $100 (in any denomination combination) for 100 $1 bills.

That is also illegal to do so.

The club can only refuse to do so if they determine the bills you are using ($5, $10, $20, $50, $100) are counterfeit or if they are low on $1 bills.

But when has any strip club been low on $1 bills? Originally Posted by CG2014

But because it is illegal to do so in Texas (except for Debit Cards),

https://www.sll.texas.gov/faqs/credit-card-surcharge/

they named it Privacy Fee instead of Credit Card Processing Fee. Originally Posted by CG2014

I found the statute:https://www.supremecourt.gov/opinion...-1391_g31i.pdf

Sec. 604A.0021. IMPOSITION OF SURCHARGE FOR USE OF CREDIT CARD. (a) In a sale of goods or services, a seller may not impose a surcharge on a buyer who uses a credit card for an extension of credit instead of cash, a check, or a similar means of payment.

(b) This section does not apply to:

(1) a state agency, county, local governmental entity, or other governmental entity that accepts a credit card for the payment of fees, taxes, or other charges; or

(2) a private school that accepts a credit card for the payment of fees or other charges, as provided by Section 111.002.

(c) This section does not create a cause of action against an individual for violation of this section.

But there's also a 2018 ruling by a federal judge in the Western District of Texas that invalidated the law as unconstitutional. My guess is that the state is no longer enforcing it because of that.

Note that the law refers simply to "a surcharge." It doesn't have to be called anything specific, so long as it's assessed on CC transactions only. Originally Posted by Sir Lancehernot

https://www.supremecourt.gov/opinion...-1391_g31i.pdf Originally Posted by TexTushHogSo are we joining a class action lmao