Nice hypothetical example to explain the theory of cutting taxes to raise revenue. The only problem is that, like Communism, it doesn't really work. Actually, as the history of the last 35 years has shown, cutting the tax rate has not produced increased income. If you remember, the Reagan tax cuts were followed by the worst post-war recession until the 2008 (Bush) recession. Remember, when the unemployment rate reached 10 % they said it was the highest since 1984. The Bush tax cuts did nothing to stop the slide into recession in 2002. What has followed tax cuts is generally an explosion in the size of the deficit. The three periods that saw the largest increases in the deficit were under Reagan, W, and Bush 1 (though he was coping with the S&L crisis). The only sustained surplus was under Clinton, who was benefiting from the Bush I tax increases. The 'cut taxes to raise revenue' is akin to 'we had to destroy this village to save it'. What we need to do is implement some of the provisions of the Simpson Commision: raise some taxes, cut others, cut a lot of programs, including Medicare, Medicaid, and the military.

Originally Posted by davec.0121

Tax Cuts INCREASE Revenues; They Have ALWAYS Increased Revenues

By Michael Eden

We keep seeing the same liberal argument being played over and over again. As the mainstream media seek to make their case to the American people that the Bush tax cuts should expire, one of the primary strategies being employed is to claim that Republicans are refusing to “pay for” their extension of the tax cuts. And that therefore the Republicans will hike the deficit. The problem is that it’s a false premise,

based on a static conception of human behavior that refuses to take into account the fact that people’s behavior changes depending upon how much of their money they are allowed to keep, and how much of their money is seized from them in taxation.

As bizarre as it might seem, it is seen as perverse these days to suggest that allowing someone to keep more of the money he or she invests would stimulate people to take

more risks by investing in businesses and products, and that such increased investment in business and products would in turn stimulate more economic growth. Common sense has become akin to rocket science these days.

Then again, liberals aren’t doing much for rocket science, either.

Let’s take a look at the current facts, and then examine the history of our greatest tax-cutting presidents.

The Falsehood That Democrats Are ‘Cutting’ Taxes

Democrats say they are cutting taxes on “95% of Americans, but argue that giving the

same tax cut benefits to the remaining 5% would hike the deficit and be fiscally irresponsible.

Well, for one thing, the Democrats are flat-out lying when they say they are cutting taxes for 95% of Americans. That can’t possibly be true,

because as a matter of simple fact a whopping 47% of American households pay no federal income taxes whatsoever.

WASHINGTON (AP) — Tax Day is a dreaded deadline for millions, but for nearly half of U.S. households it’s simply somebody else’s problem.

About 47 percent will pay no federal income taxes at all for 2009. Either their incomes were too low, or they qualified for enough credits, deductions and exemptions to eliminate their liability. That’s according to projections by the Tax Policy Center, a Washington research organization. [...]

The result is a tax system that exempts almost half the country from paying for programs that benefit everyone, including national defense, public safety, infrastructure and education. It is a system in which the top 10 percent of earners — households making an average of $366,400 in 2006 — paid about 73 percent of the income taxes collected by the federal government.

What Democrats are doing – deceitful liars that they are – is giving Americans “tax credits” and calling them “tax cuts.”

A

tax cut is a reduction in the percentage or amount of taxes that is being imposed on a citizen. The government is cutting the amount it had been collecting from taxpayers. A government cannot “cut” a citizen’s taxes unless that citizen had been paying taxes in the first place.

A

tax credit is when you give someone money that has been collected from

another taxpayer. It is redistribution of wealth. It is what Karl Marx described as “

from each according to his ability, to each according to his need.” Do you notice that “to” in the middle? It means, “transferring the wealth from one government-penalized group of people

TO another government-privileged group of people.”

It is what Obama described as “spreading the wealth around.”

What Obama and the Democrats in Congress propose is

NOT a “tax cut.” And it is nothing but a lie to call it that. And every single journalist who has suggested that it is a tax cut is as much of a liar as the Democrats are.

That’s the first point. Democrats are advancing a central tenet of Marxism and deceitfully and even demagogically relabeling it as “capitalism.” And the media helps them get away with it.

The Falsehood That Cutting Taxes For the Rich – But NOT The Other Classes – Contributes To the Deficit

Next comes

the idea Democrats argue that tax cuts for the rich contribute to the deficit.

Let’s say for the sake of argument (just for the moment; I’ll prove it’s wrong below) that tax cuts for the rich raise the deficit. Let me ask you one question: how then do tax cuts for the rest of us

not ALSO raise the deficit???

Why wouldn’t raising taxes on the middle class and the poor not correspondingly lower the deficit? So why aren’t Democrats going after them?

Are Democrats too stupid to realize that there just aren’t enough rich people to pay off our deficit, especially when this president and this Congress have raised said deficit tenfold over the last Republican-passed budget deficit?

The last budget produced by congressional Republicans was in 2007. That year, the deficit was approximately $160 billion; now under Obama, Nancy Pelosi and Harry Reid it is

$1.6 TRILLION a year as far as the eye can see.

Wouldn’t

ANY tax cuts raise the deficit? And shouldn’t we therefore tax the bejeezus out of

EVERYBODY to lower the deficit? Wouldn’t every single dollar collected reduce the deficit correspondingly?

Let me put it concretely: say I took a $100 bill out of the wallet of a millionaire. And then say I took a $100 bill out of the wallet of a poor person. If I took both bills to a Democrat, would he or she be able to tell the difference? Would he say, “Ah,

THIS bill will lower the deficit because it comes from a rich person; but

THIS one clearly won’t because it clearly came from a poor person.”

Update, Sep. 10:

A study by the Joint Tax Committee, using the same static methodology that I refer to in my opening paragraph, calculate that the government will lose $700 billion in revenue if the tax cuts for the top income brackets are extended. And that sounds bad.

But they also conclude that the Bush tax cuts on the middle class will cost the Treasury $3 TRILLION over the same period. If we can’t afford $700 billion, then how on earth can we afford $3 trillion? And then you’ve got to ask how much the Treasury is losing by not taxing the poor first into the poorhouse, and then into the street? And how much more revenue could we collect if we then imposed a “street” tax? [end update].

Hopefully you get the point: if tax cuts for the rich are bad because they increase the deficit, then they are equally bad for everyone else for the same exact reason. And so we should either tax the hell out of everyone, or cut taxes for everyone. And a consistent Democrat opposed to “deficit-hiking tax cuts for the rich” should be for raising

YOUR taxes as much as possible.

Republicans don’t fall into this fundamental contradiction (see below), because they don’t believe that tax cuts create deficits. Democrats do. Which means they are perfectly content with shockingly supermassive deficits – as long as its 95% of Americans who are creating those deficits, rather than 100%.

Joe Biden said it was a patriotic duty to pay higher taxes. And yet Democrats are trying to make 95% of Americans unpatriotic traitors who don’t care about their country?

Now, Democrats will at this point repudiate logic and punt to the issue of “fairness.” But “fairness” is a

very subjective thing, when one group of people decide it’s “fair” for another group of people to hand over their money while the first group pays nothing. Even George Bernard Shaw – a socialist, mind you – understood this. He pointed out the fact that “A government that robs Peter to pay Paul can always depend on the support of Paul.”

Which is to say it’s

NOT fair at all. Paul may think it’s fair, but poor Peter gets screwed year after year.

And it is a fundamental act of hypocrisy – not to mention advancing yet

ANOTHER central tenet of Marxist class warfare – to claim to oppose tax cuts for the rich in the name of the deficit, but not to oppose tax cuts for everyone else.

And for the record, I despise both hypocrisy

AND central tenets of Marxism. Which is why I despise the Democrat Party, which is both hypocritical and basically Marxist.

[Update, September 20] Brit Hume demolished the Obama-Democrat argument regarding the Bush tax cuts being a “cost” to the government,

saying:

“But the very language used in discussing these issues tells you something as well. In Washington, letting people keep more of their own money is considered a cost. As if all the money really belongs to the government in the first place in which what you get to keep is an expenditure.”

And, again, that mindset about government control and in fact government ownership over people’s wealth represents a profoundly Marxist view of the world. [End update].

For what it’s worth, Democrats will only maintain the massive contradiction of “tax cuts for the rich raising the deficit” for so long.

Obama already admitted he was willing to go back on his promise to raise taxes on the middle class. And his people

are already looking to tee off on middle class tax hikes. In addition, if you have any private retirement funds,

they may well be coming after you soon.

The Falsehood That Tax Cuts Increase The Deficit

Now let’s take a look at the utterly fallacious view that tax cuts in general create higher deficits.

Let’s take a trip back in time, starting with the 1920s. From Burton Folsom’s book,

New Deal or Raw Deal?:

In 1921, President Harding asked the sixty-five-year-old [Andrew] Mellon to be secretary of the treasury; the national debt [resulting from WWI] had surpassed $20 billion and unemployment had reached 11.7 percent, one of the highest rates in U.S. history. Harding invited Mellon to tinker with tax rates to encourage investment without incurring more debt. Mellon studied the problem carefully; his solution was what is today called “supply side economics,” the idea of cutting taxes to stimulate investment. High income tax rates, Mellon argued, “inevitably put pressure upon the taxpayer to withdraw this capital from productive business and invest it in tax-exempt securities. . . . The result is that the sources of taxation are drying up, wealth is failing to carry its share of the tax burden; and capital is being diverted into channels which yield neither revenue to the Government nor profit to the people” (page 128).

Mellon wrote, “It seems difficult for some to understand that high rates of taxation do not necessarily mean large revenue to the Government, and that more revenue may often be obtained by lower taxes.” And he compared the government setting tax rates on incomes to a businessman setting prices on products: “If a price is fixed too high, sales drop off and with them profits.”

And what happened?

“As secretary of the treasury, Mellon promoted, and Harding and Coolidge backed, a plan that eventually cut taxes on large incomes from 73 to 24 percent and on smaller incomes from 4 to 1/2 of 1 percent. These tax cuts helped produce an outpouring of economic development – from air conditioning to refrigerators to zippers, Scotch tape to radios and talking movies. Investors took more risks when they were allowed to keep more of their gains. President Coolidge, during his six years in office, averaged only 3.3 percent unemployment and 1 percent inflation – the lowest misery index of any president in the twentieth century.

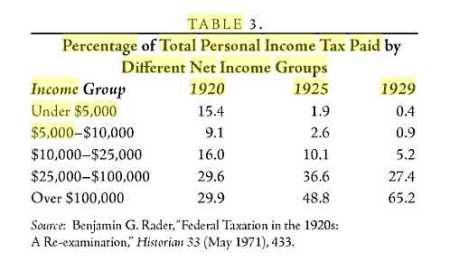

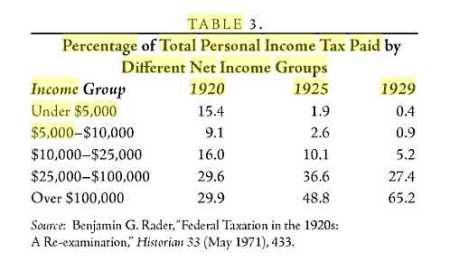

Furthermore, Mellon was also vindicated in his astonishing predictions that cutting taxes across the board would generate more revenue. In the early 1920s, when the highest tax rate was 73 percent, the total income tax revenue to the U.S. government was a little over $700 million. In 1928 and 1929, when the top tax rate was slashed to 25 and 24 percent, the total revenue topped the $1 billion mark. Also remarkable, as Table 3 indicates, is that the burden of paying these taxes fell increasingly upon the wealthy” (page 129-130).

Now, that is incredible upon its face, but it becomes even more incredible when contrasted with FDR’s antibusiness and confiscatory tax policies, which both dramatically shrunk in terms of actual income tax revenues (from $1.096 billion in 1929 to $527 million in 1935), and dramatically shifted the tax burden to the backs of the poor by imposing huge new excise taxes (from $540 million in 1929 to $1.364 billion in 1935). See Table 1 on page 125 of New Deal or Raw Deal for that information.

FDR both collected far less taxes from the rich, while imposing a far more onerous tax burden upon the poor.

It is simply a matter of empirical fact that tax cuts create increased revenue, and that those [Democrats] who have refused to pay attention to that fact have ended up reducing government revenues even as they increased the burdens on the poorest whom they falsely claim to help.

Let’s move on to John F. Kennedy, one of the most popular Democrat presidents ever. Few realize that he was also a supply-side tax cutter.

Kennedy said:

“It is a paradoxical truth that tax rates are too high and tax revenues are too low and the soundest way to raise the revenues in the long run is to cut the rates now … Cutting taxes now is not to incur a budget deficit, but to achieve the more prosperous, expanding economy which can bring a budget surplus.”

– John F. Kennedy, Nov. 20, 1962, president’s news conference

“Lower rates of taxation will stimulate economic activity and so raise the levels of personal and corporate income as to yield within a few years an increased – not a reduced – flow of revenues to the federal government.”

– John F. Kennedy, Jan. 17, 1963, annual budget message to the Congress, fiscal year 1964

“In today’s economy, fiscal prudence and responsibility call for tax reduction even if it temporarily enlarges the federal deficit – why reducing taxes is the best way open to us to increase revenues.”

– John F. Kennedy, Jan. 21, 1963, annual message to the Congress: “The Economic Report Of The President”

“It is no contradiction – the most important single thing we can do to stimulate investment in today’s economy is to raise consumption by major reduction of individual income tax rates.”

– John F. Kennedy, Jan. 21, 1963, annual message to the Congress: “The Economic Report Of The President”

“Our tax system still siphons out of the private economy too large a share of personal and business purchasing power and reduces the incentive for risk, investment and effort – thereby aborting our recoveries and stifling our national growth rate.”

– John F. Kennedy, Jan. 24, 1963, message to Congress on tax reduction and reform, House Doc. 43, 88th Congress, 1st Session.

“A tax cut means higher family income and higher business profits and a balanced federal budget. Every taxpayer and his family will have more money left over after taxes for a new car, a new home, new conveniences, education and investment. Every businessman can keep a higher percentage of his profits in his cash register or put it to work expanding or improving his business, and as the national income grows, the federal government will ultimately end up with more revenues.”

– John F. Kennedy, Sept. 18, 1963, radio and television address to the nation on tax-reduction bill

Which is to say that modern Democrats are essentially calling one of their greatest presidents a liar when they demonize tax cuts as a means of increasing government revenues.

So let’s move on to Ronald Reagan. Reagan had two major tax cutting policies implemented: the Economic Recovery Tax Act (ERTA) of 1981, which was retroactive to 1981, and the Tax Reform Act of 1986.

Did Reagan’s tax cuts decrease federal revenues?

Hardly:

We find that 8 of the following 10 years there was a surplus of revenue from 1980, prior to the Reagan tax cuts. And, following the Tax Reform Act of 1986, there was a

MASSIVE INCREASE of revenue.

So Reagan’s tax cuts increased revenue. But who paid the increased tax revenue? The poor? Opponents of the Reagan tax cuts argued that his policy was a giveaway to the rich (ever heard that one before?) because their tax payments would fall. But that was exactly wrong.

In reality:

“The share of the income tax burden borne by the top 10 percent of taxpayers increased from 48.0 percent in 1981 to 57.2 percent in 1988. Meanwhile, the share of income taxes paid by the bottom 50 percent of taxpayers dropped from 7.5 percent in 1981 to 5.7 percent in 1988.”

So Ronald Reagan a) collected more total revenue, b) collected more revenue from the rich, while c) reducing revenue collected by the bottom half of taxpayers, and d) generated an economic powerhouse that lasted – with only minor hiccups – for nearly three decades. Pretty good achievement considering

that his predecessor was forced to describe his own economy as a “malaise,” suffering due to a “crisis of confidence.” Pretty good

considering that President Jimmy Carter responded to a reporter’s question as to what he would do about the problem of inflation

by answering,

“It would be misleading for me to tell any of you that there is a solution to it.”

Reagan whipped inflation. Just as he whipped that malaise and that crisis of confidence.

This might explain why a Gallup poll showed that Ronald Reagan is regarded as our greatest president, while fellow tax-cutting great John F. Kennedy is tied for second with Abraham Lincoln. Because, in proving Democrat policies are completely wrongheaded, he helped people. Including poorer people who benefited from the strong economy he built with his tax policies.

Let’s move on to George Bush and the infamous (to Democrats) Bush tax cuts. And let me quote none other than the

New York Times:

Sharp Rise in Tax Revenue to Pare U.S. Deficit

By EDMUND L. ANDREWS

Published: July 13, 2005

WASHINGTON, July 12 – For the first time since President Bush took office, an unexpected leap in tax revenue is about to shrink the federal budget deficit this year, by nearly $100 billion.

A Jump in Corporate Payments On Wednesday, White House officials plan to announce that the deficit for the 2005 fiscal year, which ends in September, will be far smaller than the $427 billion they estimated in February.

Mr. Bush plans to hail the improvement at a cabinet meeting and to cite it as validation of his argument that tax cuts would stimulate the economy and ultimately help pay for themselves.

Based on revenue and spending data through June, the budget deficit for the first nine months of the fiscal year was $251 billion, $76 billion lower than the $327 billion gap recorded at the corresponding point a year earlier.

The Congressional Budget Office estimated last week that the deficit for the full fiscal year, which reached $412 billion in 2004, could be “significantly less than $350 billion, perhaps below $325 billion.”

The big surprise has been in tax revenue, which is running nearly 15 percent higher than in 2004. Corporate tax revenue has soared about 40 percent, after languishing for four years, and individual tax revenue is up as well.

[Update, September 20: The above

NY Times link was scrubbed; the same article, edited differently,

appears here.]

Note the newspaper’s use of liberals favorite adjective:

“unexpected.” They never expect Republican and conservative polices to work, but they always do if they’re given the chance. They never expect Democrat and liberal policies to fail, but they always seem to fail every single time they’re tried.

For the record,

President George Bush’s 2003 tax cuts:raised federal tax receipts by $785 billion, the largest four-year revenue increase in U.S. history. In fiscal 2007, which ended last month, the government took in 6.7% more tax revenues than in 2006.

These increases in tax revenue have substantially reduced the federal budget deficits. In 2004 the deficit was $413 billion, or 3.5% of gross domestic product. It narrowed to $318 billion in 2005, $248 billion in 2006 and $163 billion in 2007. That last figure is just 1.2% of GDP, which is half of the average of the past 50 years.

Lower tax rates have be so successful in spurring growth that the percentage of federal income taxes paid by the very wealthy has increased. According to the Treasury Department, the top 1% of income tax filers paid just 19% of income taxes in 1980 (when the top tax rate was 70%), and 36% in 2003, the year the Bush tax cuts took effect (when the top rate became 35%). The top 5% of income taxpayers went from 37% of taxes paid to 56%, and the top 10% from 49% to 68% of taxes paid. And the amount of taxes paid by those earning more than $1 million a year rose to $236 billion in 2005 from $132 billion in 2003, a 78% increase.

Budget deficits are not merely a matter of tax policy; it is a matter of tax policy

AND spending policy. Imagine you have a minimum wage job, but live within your means. Then you get a job that pays a million dollars a year. And you go a little nuts, buy a mansion, a yacht, a fancy car, and other assorted big ticket items such that you go into debt. Are you really so asinine as to argue that you made more money when you earned minimum wage? But that’s literally the Democrats’ argument when they criticize Reagan (who defeated the Soviet Union and won the Cold War in the aftermath of a recession he inherited from President Carter) and George Bush (who won the Iraq War after suffering the greatest attack on US soil in the midst of a recession he inherited from President Clinton).

As a result of the Clinton-era Dot-com bubble bursting, the

Nasdaq lost a whopping 78% of its value, and

$6 trillion dollars of wealth was simply vaporized. We don’t tend to remember how bad that economic disaster was, because the 9/11 attack was such a huge experience, and because instead of endlessly blaming his predecessor, George Bush simply took responsibility for the economy, cut taxes, and fixed the problem. The result, besides the above tax revenue gains, was

an incredible and unprecedented 52 consecutive months of job growth.

Update September 12: Did somebody say something about “jobs”? Another fact to recognize is the horrendous damage that will be done to small businesses and the jobs they create if the tax cuts for the “rich” aren’t continued. As found in the

Wall Street Journal, “According to IRS data, fully 48% of the net income of sole proprietorships, partnerships, and S corporations reported on tax returns went to households with incomes above $200,000 in 2007.” Further, the

Tax Policy Center found that basically a third of taxpayers who are expected to be in the top tax bracket in 2011 generate more than half their income from a business ownership. And while Democrats love to point out that their tax hikes on the so-called rich only impact 3% of small businesses, the National Federation of Independent Business reports that that three percent employs about 25 percent of the nation’s total workforce. “

Small businesses that employ 20 to 250 workers are the most likely to be hit by an increase in the top two tax rates, according to NFIB research.

Businesses of this size employ more than 25 percent of the U.S. workforce.” So if you want jobs and an economic recovery, you simply don’t pile more punishing taxes on those “rich” people. Especially during a recession [End update].

We’re not arguing theories here; we’re talking about the actual, empirical numbers, literally dollars and cents, which confirms Andrew Mellon’s thesis, and Warren Harding’s and Calvin Coolidge’s, John F. Kennedy’s, Ronald Reagan’s, and George W. Bush’s, economic policies.

Harding and Coolidge, Reagan and Bush, with Democrat JFK right smack in the middle: great tax cutters all.

The notion that small- and limited-government conservatives who want

ALL Americans to pay less to a freedom-encroaching government are somehow “beholden to the rich” for doing so is just a lie. And a Marxist-based lie at that.

[Update, 12/15/10]:

Check out these numbers as to how the Reagan tax cuts INCREASED the taxes paid by the wealthy, and REDUCED the taxes paid by the middle class and the bottom 50% of tax payers:

Income tax burdens (from the Joint Economic Committee for the US Congress report, 1996):

1981: top 1% of earners paid 17.6% of all personal income taxes

1988: top 1% of earners paid 27.5% of all personal income taxes (+ 10%).

1981: top 10% of earners paid 48% of all personal income taxes

1988: top 10% of earners paid 57.2% of all personal income taxes (+ 9%).

So rich clearly paid MORE of the tax burden when their tax rates were LOWERED.

For the middle class:

1981: middle class paid 57.5% of all personal income taxes

1988: middle class paid 48.7% of all personal income taxes (- 9%).

The middle class’ tax burden went DOWN by 9%. They paid almost 10% LESS than what they had been paying before the Reagan cuts.

For the bottom 50%:

1981: bottom 50% paid 7.5% of all personal income taxes

1988: bottom 50% paid 5.7% of all personal income taxes (- 2%).

So the Joint Economic Economic Committee concludes that if you lower the tax rates on the rich, the rich wind up paying MORE of the tax burden and the poor end up paying LESS. When you enact confiscatory taxation policies, the people who can afford it invariably end up protecting their money. They do everything they can to NOT pay taxes because they are getting screwed. When the rates drop to reasonable rates, they don’t shelter their money; rather, they take advantage of their ability to earn more – and improve the economy by doing so – by investing. If you take away their profit, you take away their incentive to improve the economy and create jobs.