Huh? Did you say our state tax revenues grew by 1.8%? Why don't we tell everyone they "plummeted"!

Never let a good pandemic go to waste!

The Unnecessary State Covid Bailout

Governors plead poverty even as tax revenue is rolling in.

By The Editorial Board

Feb. 24, 2021 6:41 pm ET

Democrats in Congress are planning to ladle out another $350 billion to state and local governments, though many haven’t finished spending their Cares Act checks and some are running budget surpluses. This is income redistribution for public unions.

About one third of the $150 billion that Congress allocated in direct aid to state and local governments last spring still hasn’t been spent. These funds were intended to help governments cover pandemic needs amid budget shortfalls, but most haven’t needed it.

Research outfit Wirepoints recently estimated that 44 states are running surpluses for fiscal years 2020 and 2021 when Covid relief and budget reserves are included. The six outliers: New York, New Jersey, Illinois, Maryland, Hawaii, Nevada. They have pre-existing spending problems or rely heavily on tourism.

Nearly half of states rolled in more tax revenue in calendar year 2020 than 2019, according to the Reason Foundation. On average, state revenues were a mere 0.01% lower across the board. Seventeen state treasurers recently moaned to Congress that “tax revenues have plummeted,” but collectively they’ve seen a 1.8% increase year-over-year, the Kansas Policy Institute reports.

Gov. Andrew Cuomo recently warned of a $15 billion budget deficit and threatened to raise New York’s top income tax rate to 14.7%—the nation’s highest—though New York’s revenues were down a mere 1.5% from 2019. He refuses to renegotiate union contracts or cut spending.

Illinois Democrats warned of a budget doomsday to frighten voters into enacting a progressive tax last November, but the measure failed and state revenues were 0.9% lower than in 2019. Gov. J.B. Pritzker last week said improved revenues would spare schools from spending cuts. Yet he’s proposing to slash the tax-credit scholarship program that helps low-income kids attend private schools.

Some private schools have increased enrollment because they have remained open while unions have kept public schools closed. Yet Democrats want to punish low-income families seeking better educational options.

New Jersey’s revenue in 2020 was 0.4% lower than the year before, though Democrats in Trenton last fall raised the top income tax rate on earners making more than $1 million to 10.75% from 8.97%—retroactively to January 2020. Too bad for millionaires who lacked the foresight to escape to Palm Beach in 2019.

To his credit, Connecticut’s Democratic Gov. Ned Lamont has opposed a push by state legislators to raise taxes on the well-to-do and instead froze state worker pay. “Why would you want to raise taxes when you don’t have to?” he recently said. Revenue in Connecticut was down 1.2% year-over-year in 2020.

Federal stimulus has propped up state spending. Most blue states have progressive income tax structures and have benefited from booming asset prices, especially equities. California has a $15 billion surplus. Revenue last month was $3.7 billion (17%) higher than in January 2020. Democrats are now planning to spread their surplus around.

Gov. Gavin Newsom on Tuesday signed a $7.6 billion state-funded Covid spending bill that includes $600 payments to individuals earning up to $30,000. Undocumented immigrants could qualify for checks up to $1,200. Businesses will also get $2.1 billion in grants and fee waivers, which is only fair since they were forced to shut down much of last year.

Democrats in Washington like those in Sacramento are trying to obtain political relief for themselves. Most federal funds to state and local governments will invariably flow into higher union pay, pensions and benefits and other payouts to buy votes. The two defeats in the Georgia Senate runoffs are costing Republicans and American taxpayers many times over.

https://www.wsj.com/articles/the-unn...ut-11614210064

- lustylad

- 02-28-2021, 11:42 PM

- oeb11

- 03-01-2021, 07:47 AM

LL - thank you for revealing teh hypocrisy and corruption of the fiden/dpst regime.

In addition - it includes a new federal law that overturns all state 'right to Work' laws.

another bone for the big unions as the DPST's strip the medical benefits from them.

Part of teh "One Way - DPST Way" party of non-diversity, quotas. checkboxes, and insatiable desire for hyperspending and total POWER!

In addition - it includes a new federal law that overturns all state 'right to Work' laws.

another bone for the big unions as the DPST's strip the medical benefits from them.

Part of teh "One Way - DPST Way" party of non-diversity, quotas. checkboxes, and insatiable desire for hyperspending and total POWER!

- rexdutchman

- 03-01-2021, 08:49 AM

bail out ,,,, just control

- lustylad

- 03-01-2021, 09:04 AM

Remember - it's OUR MONEY being used to dole out "stimulus checks" to illegals and pay teachers not to teach!!

- WTF

- 03-01-2021, 03:41 PM

The two defeats in the Georgia Senate runoffs are costing Republicans and American taxpayers many times over.Whose fault is that?

Originally Posted by lustylad

I'd put it squarely at Trumps feet. He scared Republicans away from voting by mail with his bullshit voter fraud narrative.

The Democrats are going to spend as much money as they possibly can before they lose the House in 2022.

- Unique_Carpenter

- 03-01-2021, 05:13 PM

I do recall seeing an industrial production report last December that contained comments of inflationary pressure in the wholesale goods sector.

- bf0082

- 03-01-2021, 07:06 PM

- GastonGlock

- 03-01-2021, 07:48 PM

All I have to ask is where was the outrage when Don the Con lowered corporate tax rates and started borrowing Trillions ? He did it every year in office.......... For this great economy ! Originally Posted by bf0082

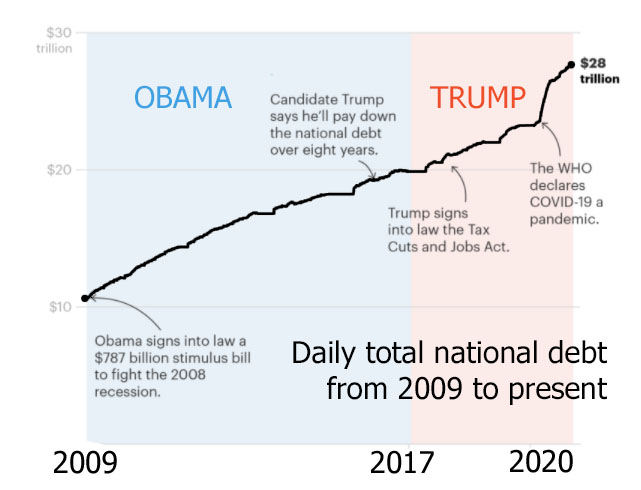

Per the chart above, in 8 years Obama raised the national debt by almost 10 trillion.

In 2017 to early 2020, he had only raised it ~3 trillion. When COVID popped off, and everything went to hell, and all the poors wanted their gibs rather than hang their tyrannical governors from a lamppost, it jumped another 3 trillion, with an additional ~2 trillion of COVID related bullshit.

So basically, if COVID didn't conveniently show up when it did, he would have nominally spent less in 1 term than Obama did in either of his terms.

And you can try to make more excuses about bad leadership, but China Joe just dumped another 3 trillion on top of it, so he's not looking so great either.

- WTF

- 03-01-2021, 08:05 PM

GG you being a tad disingenuous with your numbers and you have included the 2008 housing collapse and excluded the Covid collapse.

That seems hardly fair.

How about you compare Obama's last three years with Trump's first three.

As lustylad will tell you , I'm too lazy to do so but I will bet Trumps deficits are much more than Obama's.

That seems hardly fair.

How about you compare Obama's last three years with Trump's first three.

As lustylad will tell you , I'm too lazy to do so but I will bet Trumps deficits are much more than Obama's.

- Tiny

- 03-01-2021, 11:51 PM

Six trillion dollars in additional national debt since Covid. And now we're about to add another 1.9 trillion to it. Crazy!

Per the chart above, in 8 years Obama raised the national debt by almost 10 trillion.

In 2017 to early 2020, he had only raised it ~3 trillion. When COVID popped off, and everything went to hell, and all the poors wanted their gibs rather than hang their tyrannical governors from a lamppost, it jumped another 3 trillion, with an additional ~2 trillion of COVID related bullshit.

So basically, if COVID didn't conveniently show up when it did, he would have nominally spent less in 1 term than Obama did in either of his terms.

And you can try to make more excuses about bad leadership, but China Joe just dumped another 3 trillion on top of it, so he's not looking so great either. Originally Posted by GastonGlock

- WTF

- 03-02-2021, 06:51 AM

I do recall seeing an industrial production report last December that contained comments of inflationary pressure in the wholesale goods sector. Originally Posted by Unique_CarpenterYou'll find this interesting then

https://www.cnbc.com/2021/03/01/fed-...mists-say.html

- WTF

- 03-02-2021, 06:52 AM

- WTF

- 03-02-2021, 06:56 AM

Isn't it racist for you to refer to Obama as an orangutan?Isn't that an interesting graph. Do you think the 2020 projection will be correct? You do realize that part of your graph was just projections right? I mean no fucking way 2020 is close to correct. Why would you post such nonsense? The GDP at almost 21 trillion and deficit of around 3.3 trillion makes your 2020 deficit as a % of GDP at almost 16%.

Originally Posted by lustylad

Did you notice the deficits were dropping in Obama's last term and immediately started to rise in Trumps first term. Even when compared to a % of GDP

- bf0082

- 03-02-2021, 07:47 AM

So it's accurate information, to rob peter, and give the money to paul, telling Paul, look how great our economy is while Peter never gets repaid.Originally Posted by GastonGlock

I see a chart of Obama spending 10$T in 8 years, with tricks on viewing these numbers to make it look like Donny borrowed 10$T in 4 years, but a much smaller hill, looks deceiving to the eyes, when in fact its equal to Obama's 8 years term, much like Trump and golf, playing as much as Obama played in 8 years....

- rexdutchman

- 03-02-2021, 09:00 AM

"disguised as pulling people up " The progressives only want to h "hold down the masses" think 1984 in action .