General Electric's Harlem Horse Trade

Dan Freed

03/25/11 - 06:02 PM EDT

(

GE story updated to clarify reference to taxes.)

NEW YORK (

TheStreet) --

General Electric(

GE) Chairman and CEO Jeff Immelt and Rep. Charles Rangel (D., N.Y.) might seem like an odd pairing.

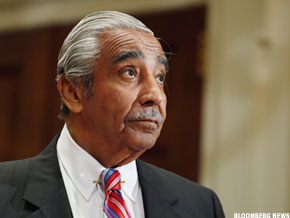

GE CEO Jeff Immelt got a big tax break from U.S. Rep. Charles Rangel (D., N.Y.), then gave $11 million to schools in Rangel's district.

GE CEO Jeff Immelt got a big tax break from U.S. Rep. Charles Rangel (D., N.Y.), then gave $11 million to schools in Rangel's district.

Immelt is a Republican who leads a giant corporation based in Fairfield, Conn. -- a town named as one of the preppiest places to live in the U.S. in the 1980 bestseller

The Preppy Handbook.

Rangel has represented the decidedly unpreppy neighborhood of Harlem in the U.S. House of Representatives for 40 years.

What the men have -- or at least had -- in common were two things: immense power and a keen interest in tax policy.

Last year, Rangel was censured by his fellow House members and stripped of his chairmanship of the Ways and Means Committee, which oversees tax policy. He isn't even allowed to vote on subcommittees.

His censure came as the result of ethics violations, including the underreporting of assets, failure to pay taxes and using government stationery to solicit donations from companies that had business before him.

General Electric is not thought to be among the companies that received these solicitations on government stationery, but a

front-page article in Friday's

The New York Times raises some troubling questions about the relationship between Rangel and Immelt, and, by extension, about corporate lobbying and U.S. tax policy.

In May 2008, while Rangel still held his chairmanship, he met with GE tax chief and former U.S. Treasury official John Samuels. Samuels dropped to one knee and begged Rangel to extend a tax break that is especially important to GE, according to the report, which notes that a GE spokeswoman said Samuels was joking.

Rangel was presumably not joking, however, when he changed his position on the issue, known as "active financing," the same day. The chairman's reversal allowed GE and other companies, including

Caterpillar(

CAT),

JPMorgan Chase (

JPM),

Ford(

F) and

IBM(

IBM) to save an estimated $4 billion annually in taxes.

A month later, Rangel and Immelt were together in Harlem announcing a

$30 million donation to benefit New York City schools, $11 million of which would go to institutions in Rangel's district.

Rangel and GE told the

Times there was no connection between GE's donation and the tax break, though the article points to what appear to be conflicting statements by Rangel about whether he discussed the donation with GE or Immelt.

These latest suggestions of influence-peddling may mean relatively little to Rangel at this point, because he already has lost much of his authority. Immelt, on the other hand, has become a central figure in President Obama's recent efforts to reach out to business. The president recently named Immelt to a high-profile post as chairmran of the President's Council on Jobs and Competitiveness, which, the

Times notes "is expected to discuss corporate taxes."

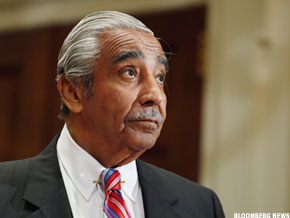

Rep. Charles Rangel, stripped of power for ethics violations.

Rep. Charles Rangel, stripped of power for ethics violations.

Depending on your point of view, Immelt and GE either know everything about taxes or they know very little. Certainly they know very little about paying them. This year's bill for General Electric? Zero. Correction: GE will get a benefit of $3.2 billion.

(What's a tax benefit? GE, which emailed me after this story published (and posted a reply in the comments section below), says it didn't receive a refund.

Here is GE's explanation.)

Bank of America(

BAC)

may be getting nearly $1 billion back for the 2010 tax year, but at least it

lost $5.4 billion. GE, on the other hand,

earned $14.2 billion.

Asked in 2009 during an investor presentation about how much influence he expected to have in a newly Democratic-controlled government, Immelt suggested GE shareholders shouldn't get their hopes up.

"I'm a Republican," Immelt said. "I mean, let's get that out there. I'm way over here, baby. So, not even close. So, I'm not sure, how much influence." A look at GE's tax bill, though, suggests he's doing just fine.

takes place.

takes place. Originally Posted by WTF

Originally Posted by WTF

GE CEO Jeff Immelt got a big tax break from U.S. Rep. Charles Rangel (D., N.Y.), then gave $11 million to schools in Rangel's district.

GE CEO Jeff Immelt got a big tax break from U.S. Rep. Charles Rangel (D., N.Y.), then gave $11 million to schools in Rangel's district.  Rep. Charles Rangel, stripped of power for ethics violations.

Rep. Charles Rangel, stripped of power for ethics violations.