Never let a good pandemic go to waste!

In case you haven't been following the federal budget blowout numbers, here's an update.

Hey, it looks like the covid crisis only nicked 1.2% off federal tax revenues last year!

Please Nancy and Chucky, tell me again why we need ANOTHER $1.9 trillion in so-called covid relief spending?

That's on top of the $4 trillion that was already approved - of which $1.3 trillion is still lying around unspent!

The Pandemic Spending Hangover

Federal debt has reached 100% of GDP even before Biden’s plans become law.

By The Editorial Board

Feb. 12, 2021 6:52 pm ET

Does unrestrained federal spending have any economic cost? Can federal debt keep climbing to be larger than the entire U.S. economy without consequence? Sooner or later Americans are going to find out, as Congress and the Biden Administration use the pandemic to justify an unprecedented peacetime spending binge.

For the magnitudes involved, the best recent overview arrived this week in the annual Congressional Budget Office’s 10-year budget forecast. It deserves more attention than it’s receiving because Americans will be paying for it for decades.

***

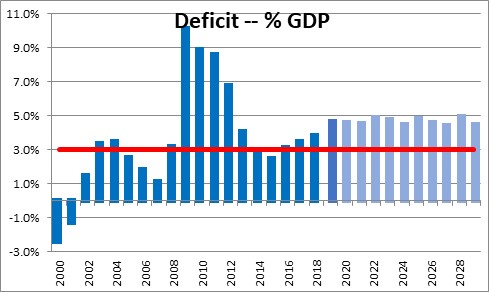

CBO says federal spending reached $6.55 trillion in fiscal 2020, as Congress addressed the damage from Covid-19 and the government shutdowns. That’s about a $2.1 trillion increase in a single year, and understandably so given the uncertainty of the threat as it emerged in the spring. Notably, and in a pleasant surprise, revenue fell a mere 1.2% to $3.42 trillion as the economy held up better than expected. The deficit came in at a staggering $3.13 trillion, or a record 14.9% of GDP.

What about the future? CBO says not to expect much fiscal improvement this year, with spending still at 26.3% of GDP. The deficit will be $2.26 trillion or 10.3% of GDP. For comparison, the deficit during Barack Obama’s entire first term was $5.1 trillion, and the deficit as a share of GDP hasn’t been that high since 1945. Even at the height of the 1983 recession, it reached only 5.9%.

CBO projects spending to average 21.9% of GDP over the next decade under current law, but that doesn’t include Mr. Biden’s $1.9 trillion Covid bill and other plans. Democrats are already promising another trillion-dollar “green” public works bill later this year. Investors must be expecting a subsidy blowout judging by the fantastic market valuations of electric car and renewable energy companies.

And don’t forget the $1.6 trillion in student loans that taxpayers stand behind; some $435 billion is already set to be cancelled. CBO doesn’t account for this writedown in its forecast—or for potential losses on the Federal Housing Administration’s $1.3 trillion insurance portfolio once pandemic rental and mortgage forbearance ends.

The best news in the report is how well the economy and revenues have held up during the pandemic. Last July CBO forecast unemployment would average 8.1% this year. It was 6.3% in January, and CBO now expects it to average 5.7% in 2021. CBO also had to slash its GDP decline for 2020 (fourth quarter to fourth quarter) to 2.5% from 5.9% in July.

Corporate profit, wages and government revenues are expected to far exceed earlier forecasts. The estimated net 10-year federal tax revenue loss from the pandemic is now a mere $49 billion. Thank you, tax reform and deregulation, for putting the pre-pandemic economy on a sturdy foundation.

A big question going forward is whether CBO’s growth estimates will survive Bidenomics, with its new taxes, new regulation, and assault on fossil fuels. During the Obama Presidency, CBO cut its GDP projections by more than $2 trillion five times, as increased spending failed to ignite growth that was suppressed by regulation and tax increases.

***

Which brings us to the federal debt, which has leapt into uncharted territory. Debt held by the public—the kind the government has to pay back—broke above 100% of the economy in fiscal 2020. Even without new Biden spending, CBO says it will reach 102.3% in fiscal 2021.

The last time federal debt exceeded 100% of GDP was in 1946. Debt held by the public never exceeded 40% of GDP even during the Reagan defense buildup, and it reached 47.9% in 1993 before declining until the 2008 recession. It has kept growing since, and exploded in the last two years, as the nearby chart shows.

How much debt is too much, and when does it begin to have corrosive economic consequences? No one knows, but one economic benchmark for harm has been 90% of GDP. We’ve never been preoccupied with debt, since the main focus of economic policy should be growth and broad prosperity.

But the U.S. has never reached these debt heights in peacetime. After World War II, the U.S. could more easily shrink the debt via economic growth because it lacked an entitlement state. As defense spending fell, so did debt as a share of GDP. Now mandatory outlays on Social Security, Medicare and the like make up 75% of the budget, and reforming those programs has proven to be politically impossible.

At the current pace of spending and debt accumulation, something else will have to give. The fiscal space for defense, public works and other priorities will be a casualty. Mr. Biden is promising a huge tax increase, which he will justify in the name of reducing debt.

A crucial question is how long America can borrow as much as it wants from the world. We have the exorbitant privilege of the dollar as the world’s reserve currency, but we still depend on the willingness of strangers to lend. Americans seem able to finance 4% to 5% of GDP in debt. Current deficits leave a lot more to finance, which will put pressure on the Federal Reserve to keep buying Treasurys and keep interest rates low for years.

We’d better hope renewed inflation doesn’t force the Fed’s hand as it did in the early 1950s during the Korean War—and that the world keeps faith in the dollar. An inflation revival would erode the value of the debt over time, but it could also create other financial problems such as a run on the dollar that causes interest rates to surge beyond the capacity of the Fed to keep them low.

We aren’t there yet, and maybe God loves fools, drunks and America, as Otto von Bismarck famously said. But then the U.S. has never conducted a fiscal experiment like this one. The laws of economics haven’t been repealed, no matter what the modern-monetary theorists say.

https://www.wsj.com/articles/the-pan...er-11613173947

- lustylad

- 02-25-2021, 12:06 AM

- Ripmany

- 02-25-2021, 12:17 AM

It not real debt it federal reserve printed money, call the fed buying debt. No body in there right mine will give us money.

- WTF

- 02-25-2021, 06:31 AM

This seems strange....Trump admin is never mentioned as the purveyor of the 3.13 2020 deficit and will be responsible for a portion of 2021. That debt good

The deficit came in at a staggering $3.13 trillion, or a record 14.9% of GDP.

What about the future? CBO says not to expect much fiscal improvement this year, with spending still at 26.3% of GDP. The deficit will be $2.26 trillion or 10.3% of GDP. For comparison, the deficit during Barack Obama’s entire first term was $5.1 trillion, and the deficit as a share of GDP hasn’t been that high since 1945. Even at the height of the 1983 recession, it reached only 5.9%. Originally Posted by lustylad

Potential Biden debt....bad.

Thank you Ronnie Reagan for getting us to this ridiculous point.

Let me give you a little homework lustylad. Could you please tell me the combination that produced the lowest deficits.

WH Democrat: House majority GOP

WH Republicans: House majority GOP

WH Democrat: House majority Democrats

WH Republican : House majority Democrats

No lying or distortions...

How is your buddy bambino btw?

- oeb11

- 02-25-2021, 08:55 AM

LL - thank yu

DPST's - part of teh strategy - is to spend America into a Venezuelan market crash - and stage a marxist take over blaming Trump!

DPST's - part of teh strategy - is to spend America into a Venezuelan market crash - and stage a marxist take over blaming Trump!

- rexdutchman

- 02-25-2021, 09:01 AM

1.9 TRILLION covid bill 02% really for covid , Refunding the WUHUN lab, Brilliant , refund the WHO brilliant , on and on Identity Politics and the myth of Beijing bob 1984 is here

- sportfisherman

- 02-25-2021, 12:15 PM

Speaking for Senators Pelosi and Schumer in regards to the question you posed ;

We need more help because we have had 4 years of the most egregiously poor executive leader in the History of the United States.

He had the economy all juiced up (with the brakes off) and got caught with a crisis he mis-handled (slow,faltering,wavering response).

And he led us off the deep end into the biggest shit hole ever.

So we have to (as usual)come in and clean up Trump and Republican bullshit.

And I think WTF is indicating by his Avatar that we could have done better if we would have had a Chimpanzee as POTUS.

We need more help because we have had 4 years of the most egregiously poor executive leader in the History of the United States.

He had the economy all juiced up (with the brakes off) and got caught with a crisis he mis-handled (slow,faltering,wavering response).

And he led us off the deep end into the biggest shit hole ever.

So we have to (as usual)come in and clean up Trump and Republican bullshit.

And I think WTF is indicating by his Avatar that we could have done better if we would have had a Chimpanzee as POTUS.

- WTF

- 02-25-2021, 12:21 PM

- Unique_Carpenter

- 02-25-2021, 01:09 PM

Lusty,

Sorry, it's not a drunk behind the wheel.

It's a Zombie behind the wheel.

As it's clinically impossible to have a drunk Zombie, we simply have what it is.

Sorry, it's not a drunk behind the wheel.

It's a Zombie behind the wheel.

As it's clinically impossible to have a drunk Zombie, we simply have what it is.

- WTF

- 02-25-2021, 03:46 PM

We had an Orange Orangutan behind the wheel for the four years prior to the Zombie! Biggest deficits in out history as a nation.

I'll not comment on thprior 16 years to that shit show....but they were only marginally better.

I'll not comment on thprior 16 years to that shit show....but they were only marginally better.

- Tiny

- 02-25-2021, 04:55 PM

Please Nancy and Chucky, tell me again why we need ANOTHER $1.9 trillion in so-called covid relief spending? Originally Posted by lustyladSilly, So they can buy off voters and win the 2024 elections, of course. Besides, what's another measly 10% of GDP anyway? A trillion dollars just ain't what it use to be.

- WTF

- 02-25-2021, 07:21 PM

- Ripmany

- 02-28-2021, 01:25 AM

If there's no stopping there's no need for a seatbelt you only need the seatbelt when you come to sudden stop and go through the windshield

- lustylad

- 02-28-2021, 10:52 PM

- lustylad

- 02-28-2021, 11:12 PM

C'mon man! What's another 10% of GDP anyway? Never let a good pandemic go to waste!

The Non-Covid Spending Blowout

Most of the $1.9 trillion House bill has little to do with the virus. Here’s a breakdown.

By The Editorial Board

Updated Feb. 21, 2021 5:12 pm ET

The Biden White House is pointing to polls showing that its $1.9 trillion spending bill is popular, and the press corps is cheering. Yet we wonder how much public support there’d be if Americans understood that most of the blowout is a list of longtime Democratic spending priorities flying under the false flag of Covid-19 relief.

Let’s dig into the various House committee bills to separate the Covid from the chaff. The Covid cash includes some $75 billion for vaccinations, treatments, testing and medical supplies. There’s also $19 billion for “public health,” primarily for state health departments and community health centers. One might even count the $6 billion to the Indian Health Service, or $4 billion for mental health.

The package also hands more to businesses and individuals most hit by lockdowns. That includes $7.2 billion more for the Paycheck Protection Program, $15 billion for economic injury disaster loans, $26 billion for restaurants, bars and live venues, and $15 billion in payroll support for airlines. The recipients of this taxpayer money will at least be required to prove economic harm, and in some cases repay loans.

Not so the recipients of the $413 billion in checks Democrats intend to send to households far and wide, at $1,400 per man, woman and dependent, that begins phasing out at $75,000 of individual income. The Congressional Budget Office says the bill’s unemployment provisions will increase deficits by $246 billion, and that its $400 a week in federal “enhanced” unemployment benefits through August “could increase the unemployment rate as well as decrease labor force participation.” So much for economic stimulus.

All told, this generous definition of Covid-related provisions tallies some $825 billion. The rest of the bill—more than $1 trillion—is a combination of bailouts for Democratic constituencies, expansions of progressive programs, pork, and unrelated policy changes.

***

• Start with the $350 billion for state and local governments and cities and counties, even as state revenues have largely recovered since the spring. Democrats also changed the funding formula to ensure most of the dollars go to blue states that imposed strict economic lockdowns.

Last year’s Cares Act distributed money mainly by state population, but much of the $220 billion for states in the new bill will be allocated based on average unemployment over the three-month period ending in December. Andrew Cuomo’s New York (8.2% unemployment in December) and Gavin Newsom’s California (9%) get rewarded for crushing their businesses, while Kristi Noem’s South Dakota (3%) is penalized for staying open. These windfalls come with few strings attached.

• The bill includes $86 billion to rescue 185 or so multiemployer pension plans insured by the Pension Benefit Guaranty Corp. Managed jointly by employer sponsors and unions, these plans are chronically underfunded due to lax federal standards and accounting rules. Yet the bailout comes with no real reform.

• Elementary and secondary schools get another $129 billion, whether they reopen for classroom learning or not. Higher education gets $40 billion. The CBO notes that since Congress already provided some $113 billion for schools—and as “most of those funds remain to be spent”—it expects that 95% of this new money will be spent from 2022 through 2028. That is, when the pandemic is over.

• Enormous sums go to expanding favorite Democratic programs. The package adds $35 billion to pump up subsidies to defray ObamaCare premiums. The bill eliminates the existing income cap (400% of the poverty level) on who qualifies for subsidies, and lowers the maximum amount participants are expected to contribute to about 8.5% of their income, down from 10%.

The bill also spends $15 billion to provide a temporary five percentage-point increase in the federal Medicaid match to states that expand eligibility to lower-income adults. This is bait for the dozen or so states that have resisted ObamaCare’s Medicaid expansion, which enrolls working age, childless adults above the poverty line. The political goal overall is to chip away at private coverage on the way to Medicare for All.

• There’s $39 billion for child care; $30 billion for public transit agencies; $19 billion in rental assistance; $10 billion in mortgage help; $4.5 billion for the Low Income Home Energy Assistance program; $3.5 billion for the program formerly known as food stamps; $1 billion for Head Start; $1.5 billion for Amtrak; $50 billion for the Federal Emergency Management Agency; $4 billion to pay off loans of “socially disadvantaged” farmers and ranchers; and nearly $1 billion in world food assistance.

• Don’t forget the $15 an hour minimum wage, which CBO estimates will cost 1.4 million jobs. The bill increases the child tax credit to $3,000 from $2,000 ($99 billion) and temporarily expands the Earned Income Tax Credit to certain additional childless adults ($25 billion). It eliminates the cap on the rebate that drug makers must pay Medicaid for outpatient drugs. This is a rare provision that increases federal revenue ($16 billion), though only by undermining pharmaceutical innovation.

• This being Congress, Members are also slipping in pet causes. Our favorite is $1.5 million for the Seaway International Bridge, which connects New York to Canada and is a priority for New York Sen. Chuck Schumer. And don’t overlook the nearly $500 million for, as the CBO puts it, “grants to fund activities related to the arts, humanities, libraries and museums, and Native American language preservation.”

No wonder Democrats want to pass all this on a partisan vote. It’s a progressive blowout for the ages that does little for the economy but will finance Democratic interest groups for years. Please don’t call it Covid relief.

https://www.wsj.com/articles/the-non...ut-11613937485

The Non-Covid Spending Blowout

Most of the $1.9 trillion House bill has little to do with the virus. Here’s a breakdown.

By The Editorial Board

Updated Feb. 21, 2021 5:12 pm ET

The Biden White House is pointing to polls showing that its $1.9 trillion spending bill is popular, and the press corps is cheering. Yet we wonder how much public support there’d be if Americans understood that most of the blowout is a list of longtime Democratic spending priorities flying under the false flag of Covid-19 relief.

Let’s dig into the various House committee bills to separate the Covid from the chaff. The Covid cash includes some $75 billion for vaccinations, treatments, testing and medical supplies. There’s also $19 billion for “public health,” primarily for state health departments and community health centers. One might even count the $6 billion to the Indian Health Service, or $4 billion for mental health.

The package also hands more to businesses and individuals most hit by lockdowns. That includes $7.2 billion more for the Paycheck Protection Program, $15 billion for economic injury disaster loans, $26 billion for restaurants, bars and live venues, and $15 billion in payroll support for airlines. The recipients of this taxpayer money will at least be required to prove economic harm, and in some cases repay loans.

Not so the recipients of the $413 billion in checks Democrats intend to send to households far and wide, at $1,400 per man, woman and dependent, that begins phasing out at $75,000 of individual income. The Congressional Budget Office says the bill’s unemployment provisions will increase deficits by $246 billion, and that its $400 a week in federal “enhanced” unemployment benefits through August “could increase the unemployment rate as well as decrease labor force participation.” So much for economic stimulus.

All told, this generous definition of Covid-related provisions tallies some $825 billion. The rest of the bill—more than $1 trillion—is a combination of bailouts for Democratic constituencies, expansions of progressive programs, pork, and unrelated policy changes.

***

• Start with the $350 billion for state and local governments and cities and counties, even as state revenues have largely recovered since the spring. Democrats also changed the funding formula to ensure most of the dollars go to blue states that imposed strict economic lockdowns.

Last year’s Cares Act distributed money mainly by state population, but much of the $220 billion for states in the new bill will be allocated based on average unemployment over the three-month period ending in December. Andrew Cuomo’s New York (8.2% unemployment in December) and Gavin Newsom’s California (9%) get rewarded for crushing their businesses, while Kristi Noem’s South Dakota (3%) is penalized for staying open. These windfalls come with few strings attached.

• The bill includes $86 billion to rescue 185 or so multiemployer pension plans insured by the Pension Benefit Guaranty Corp. Managed jointly by employer sponsors and unions, these plans are chronically underfunded due to lax federal standards and accounting rules. Yet the bailout comes with no real reform.

• Elementary and secondary schools get another $129 billion, whether they reopen for classroom learning or not. Higher education gets $40 billion. The CBO notes that since Congress already provided some $113 billion for schools—and as “most of those funds remain to be spent”—it expects that 95% of this new money will be spent from 2022 through 2028. That is, when the pandemic is over.

• Enormous sums go to expanding favorite Democratic programs. The package adds $35 billion to pump up subsidies to defray ObamaCare premiums. The bill eliminates the existing income cap (400% of the poverty level) on who qualifies for subsidies, and lowers the maximum amount participants are expected to contribute to about 8.5% of their income, down from 10%.

The bill also spends $15 billion to provide a temporary five percentage-point increase in the federal Medicaid match to states that expand eligibility to lower-income adults. This is bait for the dozen or so states that have resisted ObamaCare’s Medicaid expansion, which enrolls working age, childless adults above the poverty line. The political goal overall is to chip away at private coverage on the way to Medicare for All.

• There’s $39 billion for child care; $30 billion for public transit agencies; $19 billion in rental assistance; $10 billion in mortgage help; $4.5 billion for the Low Income Home Energy Assistance program; $3.5 billion for the program formerly known as food stamps; $1 billion for Head Start; $1.5 billion for Amtrak; $50 billion for the Federal Emergency Management Agency; $4 billion to pay off loans of “socially disadvantaged” farmers and ranchers; and nearly $1 billion in world food assistance.

• Don’t forget the $15 an hour minimum wage, which CBO estimates will cost 1.4 million jobs. The bill increases the child tax credit to $3,000 from $2,000 ($99 billion) and temporarily expands the Earned Income Tax Credit to certain additional childless adults ($25 billion). It eliminates the cap on the rebate that drug makers must pay Medicaid for outpatient drugs. This is a rare provision that increases federal revenue ($16 billion), though only by undermining pharmaceutical innovation.

• This being Congress, Members are also slipping in pet causes. Our favorite is $1.5 million for the Seaway International Bridge, which connects New York to Canada and is a priority for New York Sen. Chuck Schumer. And don’t overlook the nearly $500 million for, as the CBO puts it, “grants to fund activities related to the arts, humanities, libraries and museums, and Native American language preservation.”

No wonder Democrats want to pass all this on a partisan vote. It’s a progressive blowout for the ages that does little for the economy but will finance Democratic interest groups for years. Please don’t call it Covid relief.

https://www.wsj.com/articles/the-non...ut-11613937485

- lustylad

- 02-28-2021, 11:23 PM

Lookee here! Nancy and Chucky want to reward the teachers for refusing to teach! A $128 billion federal slush fund for the next 8 years! Yippee!

Never let a good pandemic go to waste!

Covid ‘Relief’ Through 2028

Schools are getting billions they can spend over nearly a decade.

By The Editorial Board

Feb. 23, 2021 11:44 am ET

Perhaps you’ve heard that the $1.9 trillion House spending bill is meant to provide “urgent” and “emergency” relief. But did you know that the Covid emergency in America’s schools will apparently last through 2028?

The House proposal showers K-12 schools with nearly $129 billion. That’s on top of the $13.2 billion allocated in last spring’s Cares Act and the $54.3 billion in December’s bipartisan splurge. According to the Congressional Budget Office, schools have spent only a fraction of that previous $67.5 billion. It’s hard to spend money when schools aren’t open for classroom instruction since unions have resisted returning to work in much of the country.

Because of this leftover cash, CBO estimates that a mere $6.4 billion of the new aid package will be spent for K-12 schools in the 2021 fiscal year. That’s right—only $6 billion of $129 billion will be spent during the pandemic emergency.

CBO estimates that $32.1 billion will be spent in fiscal 2022 on K-12 schools, $32.1 billion in 2023, $25.7 billion in 2024, $19.3 billion in 2025, $9 billion in 2026, $2.6 billion in 2027, and $1.3 billion in 2028.

In other words, this isn’t about Covid relief. School districts can spend the funds on a wide range of options—from sanitizing classrooms to “continuing to employ existing staff of the local educational agency”—and the money is fungible. This means that, after the pandemic eases perhaps as soon as this year, school districts are likely to use the money to pad their bureaucracies and teacher payrolls. One of the bill’s few limitations is that local educational agencies must spend 20% of their funds to address “learning loss” with interventions such as summer school or extended-day programs. This would require more money for teacher pay or additional hiring for union dues-paying positions.

You can bet many districts will also use the money for pensions and higher salaries. The bill is essentially a nearly decade-long subsidy for the unions that supported Joe Biden.

House Democrats on the Education and Labor Committee rejected amendments stipulating that schools return to the classroom to receive money. They also nixed an amendment from Illinois Rep. Mary Miller that would have directed money to education savings accounts in districts where public schools stayed closed. Unlike the December bill, this one sets aside almost no money for private schools—though most of them have returned in part or whole to classroom teaching.

The December bill and Cares Act gave governors discretion over a few billion dollars of education funds, which they could apply to private schools or vouchers. But the new bill directs money to school districts, which must give funds to private schools only to provide “equitable services” such as tutoring and special education programs. Only private schools with a certain number of low-income students are eligible.

These facts underscore the political nature of the House spending bill. Democrats are using the banner of “Covid relief” not to increase student learning but to reward a Democratic constituency at taxpayer expense.

https://www.wsj.com/articles/covid-r...28-11614098697

Never let a good pandemic go to waste!

Covid ‘Relief’ Through 2028

Schools are getting billions they can spend over nearly a decade.

By The Editorial Board

Feb. 23, 2021 11:44 am ET

Perhaps you’ve heard that the $1.9 trillion House spending bill is meant to provide “urgent” and “emergency” relief. But did you know that the Covid emergency in America’s schools will apparently last through 2028?

The House proposal showers K-12 schools with nearly $129 billion. That’s on top of the $13.2 billion allocated in last spring’s Cares Act and the $54.3 billion in December’s bipartisan splurge. According to the Congressional Budget Office, schools have spent only a fraction of that previous $67.5 billion. It’s hard to spend money when schools aren’t open for classroom instruction since unions have resisted returning to work in much of the country.

Because of this leftover cash, CBO estimates that a mere $6.4 billion of the new aid package will be spent for K-12 schools in the 2021 fiscal year. That’s right—only $6 billion of $129 billion will be spent during the pandemic emergency.

CBO estimates that $32.1 billion will be spent in fiscal 2022 on K-12 schools, $32.1 billion in 2023, $25.7 billion in 2024, $19.3 billion in 2025, $9 billion in 2026, $2.6 billion in 2027, and $1.3 billion in 2028.

In other words, this isn’t about Covid relief. School districts can spend the funds on a wide range of options—from sanitizing classrooms to “continuing to employ existing staff of the local educational agency”—and the money is fungible. This means that, after the pandemic eases perhaps as soon as this year, school districts are likely to use the money to pad their bureaucracies and teacher payrolls. One of the bill’s few limitations is that local educational agencies must spend 20% of their funds to address “learning loss” with interventions such as summer school or extended-day programs. This would require more money for teacher pay or additional hiring for union dues-paying positions.

You can bet many districts will also use the money for pensions and higher salaries. The bill is essentially a nearly decade-long subsidy for the unions that supported Joe Biden.

House Democrats on the Education and Labor Committee rejected amendments stipulating that schools return to the classroom to receive money. They also nixed an amendment from Illinois Rep. Mary Miller that would have directed money to education savings accounts in districts where public schools stayed closed. Unlike the December bill, this one sets aside almost no money for private schools—though most of them have returned in part or whole to classroom teaching.

The December bill and Cares Act gave governors discretion over a few billion dollars of education funds, which they could apply to private schools or vouchers. But the new bill directs money to school districts, which must give funds to private schools only to provide “equitable services” such as tutoring and special education programs. Only private schools with a certain number of low-income students are eligible.

These facts underscore the political nature of the House spending bill. Democrats are using the banner of “Covid relief” not to increase student learning but to reward a Democratic constituency at taxpayer expense.

https://www.wsj.com/articles/covid-r...28-11614098697