House Republicans just voted unanimously to repeal the Democrats' army of 87,000 IRS agents. Meanwhile, Democrats voted en masse to protect the vast expansion of the IRS, which is already disproportionately targeting lower-income Americans, which Dems swore wouldn’t be the case. They lied.

This was their very first act of the new Congress

The first bill:

* is only 2 pages long

* is about a single topic

* was noticed with enough time to read

* was voted on by Members who show up to vote in person

* works to combat the weaponization of the Government against the People

all part of the new rules negotiated by the 20 patriots like Chip Roy, Scott Perry, Matt Gaetz and others

- berryberry

- 01-09-2023, 10:42 PM

- eyecu2

- 01-10-2023, 04:30 AM

Proves that Repturds will vote in lock step on media buzz -worthy bills. The claims of the 87k IRS workers was against low to middle ince earners has ALWAYS been a mere allegation from the right with bought and paid for opinion heads.

The left positioned these as looking into fraudsters like rich slumlords and real estate shenanigan types, to ensure they pay their fair share.

I would agree the entire VENMO taxation seemed suspect but once again the GOP will protect their donor base.

Imagine as a first bill, you're busy undoing anything to keep the rich people's status quo, and there you have the real driver of the Bought & Paid for, folks on the right. They won't make one bill or law that helps the average American. They will however gaslight their entire constituents to think they are protecting them. Gullible Ordinary People..the real GOP acronym.

The left positioned these as looking into fraudsters like rich slumlords and real estate shenanigan types, to ensure they pay their fair share.

I would agree the entire VENMO taxation seemed suspect but once again the GOP will protect their donor base.

Imagine as a first bill, you're busy undoing anything to keep the rich people's status quo, and there you have the real driver of the Bought & Paid for, folks on the right. They won't make one bill or law that helps the average American. They will however gaslight their entire constituents to think they are protecting them. Gullible Ordinary People..the real GOP acronym.

- Jacuzzme

- 01-10-2023, 05:32 AM

So you’re pro irs harassment? That’s a bold stance, given the recent revelations that most people audited were poor slobs who take the eitc.

- jmichael

- 01-10-2023, 07:57 AM

- eyecu2

- 01-10-2023, 08:32 AM

So youíre pro irs harassment? Thatís a bold stance, given the recent revelations that most people audited were poor slobs who take the eitc. Originally Posted by JacuzzmeNot pro IRS at all. But let's not perfume on a pig and call it perty.

I think those who game the system need to be audited. If you unfairly claimed the fat EITC for kids, then you need to have valid SSI numbers or ask for the money ina refund. It's the cavalcade of dumbass talking heads who have been lying that this is a tax on the poor. The vast majority of audits happening self employed businesses and higher income earners.

But top triggers (which are likely subjective to any writers investigation) are:

Under-reporter income.

Questionable deductions or losses.

Undocumented filing status deductions or credits.

Math errors.

Not reporting foreign accounts.

Making lots of money.

Majority of cash transactions.

Making large charitable deductions.

There are many more reasons, but I can tell you from my experience in an audit, it's usually not fun, but it's also not the end. Keep good records and you'll come out on top, or at worse, a minor tax due. I know some ppl who fudged numbers and got fucked. But that's why they audit people to make sure the fudgers pay their share. I know there has been discussions about moving towards a national sales tax in some mindsets, but that truly does penalize the low to Middle class, since they are the ones that spend 99.9% or more of their money. Rich folks at that point getting automatic tax break, since they are not purchasing commodities and goods on a similar percentile basis. However does capture things like those folks who operate off the grid like drug dealers, prostitutes and others whose activities are considered illegal. I think they're probably should be some hybrid component, just like we have a gas tax in PA, at least they're contributing a fair share to that. However in general I'm not a fan of taxation at all, and would like to keep more of my own money. I just wanted to be fair amongst the masses - to my knowledge the only way to do that is to have enforcement agency like the IRS.

I think our tax code is way too complicated and offers too many write-offs for special interest groups. Further if you fall into this special interest groups, your chances of being audited should move up significantly from the single digits to the upper 20% percentile. And that includes all tax exempt places, non profits and churches. Last time I checked, if you want to see where a lot of money is at it's in those places

- mtnitlion

- 01-10-2023, 08:38 AM

Typical Republican act.

Let’s save the rich from taxes.

Let the working man find the country.

Fucking assholes

Let’s save the rich from taxes.

Let the working man find the country.

Fucking assholes

- oldman2525

- 01-10-2023, 08:48 AM

Typical Republican act.

Letís save the rich from taxes.

Let the working man find the country.

Fucking assholes Originally Posted by mtnitlion

Such a warped theory... taxes for the middle class and lower fell dramatically under the tax law passed when Trump was president. You think for one minute the demo are for the working class? Lol

Explain to me how ms aoc Cortez went from being a waitress went to become a member of congress and in a few short years is now worth 29 million? Lol

As Trump said in the debate with Hillary, the system is rigged period. He used the system but the system was put into place by both the demo and Republicans in congress. And it wo t change. Greed and money Control the congress. Anyone who foolishly believes one party is better for the working class is better is blind.

- Jacuzzme

- 01-10-2023, 10:26 AM

“Working man” isn’t synonymous with low income, and low income people fund nothing. If we want European style social services, the poor need to start paying their fair share.

- berryberry

- 01-10-2023, 11:40 AM

So you’re pro irs harassment? That’s a bold stance, given the recent revelations that most people audited were poor slobs who take the eitc. Originally Posted by JacuzzmeExactly - as you can see from this thread, not only are the Crazy Ass leftists in the House pro-IRS harassment, so are all the leftists here

"One group that hasn't benefited from the shrinking IRS are lower-income taxpayers. Those who earn less than $25,000 and qualify for the Earned Income Tax Credit are audited at five times the rate of everyone else, TRAC found. In fiscal year 2022, nearly 1.3% of these tax returns were subject to an in-person or mail audit.

By comparison, the average audit rate for all tax returns was just 0.4% last year. "

So much for the lies being spread that the Democrats are for the lower income taxpayers and that the GOP cutting this IRS harassment is to benefit the rich

- berryberry

- 01-10-2023, 11:45 AM

Typical Republican act.Perhaps you want to educate yourself and learn the real facts

Letís save the rich from taxes.

Let the working man find the country.

Fucking assholes Originally Posted by mtnitlion

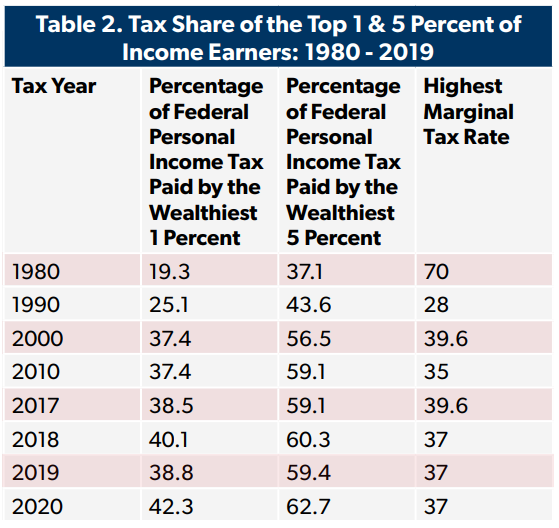

In 2019, the bottom 50 percent of taxpayers (taxpayers with AGI below $44,269) earned 11.5 percent of total AGI and paid 3.1 percent ($48.4 billion) of all federal individual income taxes.

The top 1 percent (taxpayers with AGI of $546,434 and above) earned 20.1 percent of total AGI in 2019 and paid 38.8 percent of all federal income taxes.

In 2019, the top 1 percent of taxpayers accounted for more income taxes paid than the bottom 90 percent combined. The top 1 percent of taxpayers paid $612 billion in income taxes while the bottom 90 percent paid $461 billion in income taxes.

And it keeps getting worse. So much for the lies the Trump Tax Cuts benefited the rich

- snoopy75

- 01-10-2023, 11:50 AM

Wow, a bill about a single topic. Where's the pork? So many politicians (D and R) shifting in their seat over this...